The best news I’ve heard in a long time from our industry is that Anglo American, the multinational British-based mining company, is considering a sale of De Beers. Included among its top suitors are Persian Gulf sovereign wealth funds, and luxury entities.

Sorting rough diamonds in the De Beers mine in the 19th century

Sorting rough diamonds in the De Beers mine in the 19th century

Sale or Takeover?

But Anglo American itself is a target for a takeover after receiving a bid from its largest competitor, Australian mining conglomerate BHP for $39B. The current bid was rejected by Anglo due to its objections that Anglo divest its platinum and ore industries in South Africa.

Long Held Relationship

Anglo American has a deep history with DeBeers going back over a century. In 1917, gold and diamond entrepreneur Sir Ernest Oppenheimer founded Anglo American. By 1926, the company became the largest single shareholder of De Beers Consolidated Mines. By 1929 Oppenheimer became De Beers chairman.

In 2011 following the death Oppenheimer’s son Harry (1908-2000) who was chairman of Anglo and De Beers -- the family sold its 40% stake in De Beers to Anglo American for $5.1B (with a valuation of c. $11B for the entire company.)

Revised Valuation

But recently Anglo American has downgraded the value of De Beers by $1.6B - or 17%. As of February 2024 it valued the mining company at $7.6B. 15% is still owned by the Botswana Government.

De Beers Through the Years

The name DeBeers was once synonymous with the entire global diamond brand, and Harry Oppenheimer was called Mr. Diamond. De Beers owned 91% of the world’s rough diamond market at one time. But that was a long time ago. Harry Oppenheimer called Mr. Diamond

Harry Oppenheimer called Mr. DiamondToday De Beers market share is less than 30% of that global industry. What was once a money-making machine and a monopoly, now claims it may lose $250M or more this year.

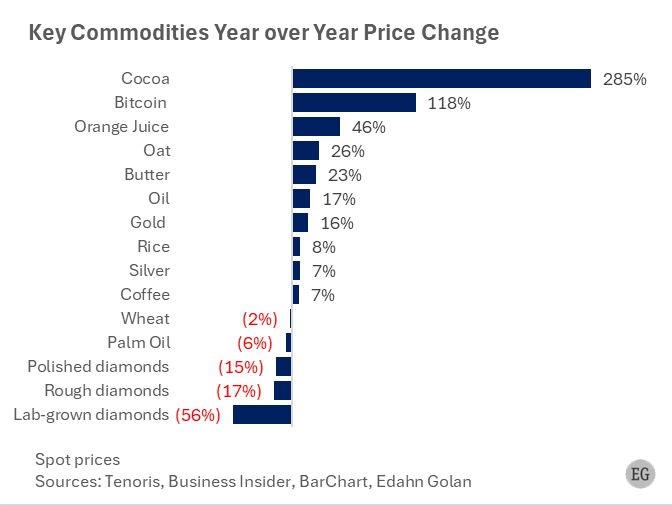

Key Commodities Year over Year Price Change (Edahn Golan)

Key Commodities Year over Year Price Change (Edahn Golan)

Duncan Wanblad (De Beers Chairman)

De Beers Store at Madison Avenue in NYC

LVMH, which bought Tiffany in 2021 completely reimagined the brand and turned it around in short order. So it certainly could breathe life back into the ailing diamond brand. In doing so, the legendary De Beers slogan, Diamonds are Forever, would dominate the minds of luxury consumers once again.

Flagship Store of Tiffany

This potential deal of bringing DeBeers under the umbrella of a luxury brand provides us with great hope that diamonds will shine again and be sold at retailers as a unique one-of a-kind cherished item.

PS---But here is a critical first step to this to ensure its success. De Beers must sell LIGHTBOX and get rid of that nasty bug riding on the back of a luxury product.

|

|

.png)