You saw it coming, didn’t you?

At long last, DeBeers finally admitted that the marketing flop of their own LGD brand called LIGHTBOX was a phenomenal blunder evidenced by staggering losses in 2023 of around $7B.

This enormous misstep simultaneously wreaked havoc within the entire diamond trade causing widespread losses.

The Industrial Diamond Niche

It’s time to move on and let LIGHTBOX produce industrial diamonds now, which will have no impact on the luxury goods sector.

The USGS (United States Geological Survey) reports, “Diamonds may well be the world's most versatile engineering material. The superiority of diamonds in so many diverse industrial applications is attributable to a unique combination of properties that cannot be matched by any other material. For example, a diamond is the strongest and hardest known material and has the highest thermal conductivity of any material at room temperature.”

Statista.com (US Industrial diamond market value 2014-2025) shares its market analysis. “The market value of industrial diamonds in the United States is forecast to amount to 238.1 billion U.S. dollars in 2025. Overall, industrial diamonds have a low value as gems, but are important in the mining and metalworking industries.”

Industrial Diamonds

Its industrial application, completely separate from the gemstone niche would be both profitable and free from its negative consequences to the diamond trade. Are LGD producers missing this potential bonanza by not yet pivoting away from jewelry and toward LGDs industrial application?

Re-stating the Brand Message

Promoting and restoring the tarnished image of the natural diamond brand is now top a priority.

Natural diamonds have long been a symbol of heartfelt sentiments to consumers. The desire to own a real natural diamond rests on its relationship to the eternal commitment couples make, sealed with a stone that is also forever. Engagement and Diamonds (Credit Image: Courtesy of Paul Zimnisky)

Engagement and Diamonds (Credit Image: Courtesy of Paul Zimnisky)

Where’s the Sentiment?

Regrettably, the weekly Rapaport Diamond Price List heavily conveys the impression that diamonds are just another commodity like soya beans. Witnessing the prices fluctuate constantly and mostly go down --- begs the question—"so they [diamonds] are not forever?”

Meanwhile, at JCK Vegas

At June’s JCK Vegas show, Martin Rapaport hosted his fancy breakfasts, making bold newsworthy declarations. But those grand gestures could not lift the heavy feeling we’ve had to bear.

De Beers CEO Al Cook’s Vegas statements extolled the promotion of the origin of diamonds. But he actually only referred to promoting the DeBeers stones, not the diamond brand at large.

Let’s consider a much broader concept instead. Promoting all natural diamonds would reflect on DeBeers own goods much more positively, and it would give the industry a much needed boost in a positive spirit.

The Perfect Photo Opp

The big bear hug Botswana’s President Mokgweetsi Masisi gave Martin Rapaport onstage was stunning to witness. Next, I heard him whisper something in Martin’s ear---but what was it?

Turning my hearing aid up to high volume, I think I could hear Masisi’s deep whispered message from far away.

Martin Rapaport and Botswana’s President Mokgweetsi Masisi

Masisi: “Martin, I would like extend a cordial invitation for you and your entire team to a 3 month wildlife safari in Botswana. It will be the trip of a lifetime!”

“Oh, that’s so nice of you”, smiled Martin. “There must be some strings attached. How can I reciprocate your generous gesture?”What do I have to do to earn that?

Masisi: “Nothing - just keep your mouth shut and don’t make any negative comments on the polished diamond market for 3 months. Don’t publish your poisonous comments for 3 months. Let the market recover from any comments and regain its natural health.”

Martin: “And all this will be on the house? Is that what you’re saying?”

Masisi gave Martin another bear hug and took a smiling selfie with his arms around Martin.

But this time, it was impossible to hear Martin Rapaport’s response. Don’t read me wrong, I don’t blame Martin Rapaport solely for the declining diamond prices- but his comments poison the market. The high interest rates and the collapse of the China trade, together with the LGD frenzy and DeBeer's missteps promoting the LGD, all contributed to the disaster. How does one explain that at the same time, natural Rubies have increased in price by 40% and Sapphires by 25%, with auction houses having the greatest time selling hundreds of millions of dollars in Fancy Colors and fine Gemstones?

Instagram lit up with pro and con responses to the Masisi-Rapaport photo opp. It would make anyone with a vested interest in diamond rehabilitation smolder.

Simply put, this precarious market needs medication to heal, not poison to finish it off. Repeatedly telling the patient that you are sick and getting worse actually makes him much worse.

We’re at a decisive junction, to be sure. The market needs to recover, yet we see Rapaport pushing it back down with his weekly list.

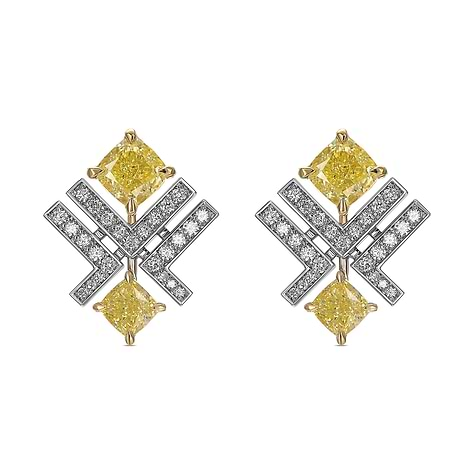

While we wait to discover the outcome of these latest events, our spirits are buoyed by recent figures emerging from the colored stone sector.

Color Stones Health Report

Take a look at Gemfields high quality emerald sales. Their May sale of emeralds from the mine in Zambia was robust despite a generally softening market. Their 5 mini auctions from May 13-30 resulted in an impressive 93% sold by lot and 87% sold by weight. The sale brought in $35M---a superb outcome. Last year Gemfields canceled its November sale, citing lower quality and quantity emerald production at Kagem—a Gemfields mine. All in all, the company has generated over $1B in revenue since opening in 2009.

Behind this upbeat scenario is the lack of available good-quality stones. As reported in National Jeweler (State of Colored Stones; Why the Market is More Colorful than Ever) after GemFair Tucson 2024,“If you see a gemstone, especially in finer quality at this [Tucson] show, this is the time to buy it,” Stuart Robertson, president of Gemworld International Inc., encouraged the audience on the near-term outlook for the gemstone market.

.png)