Diamond and gemstone lovers have a lot of data to unpack when assessing the wide chasm in pricing between colorless diamonds and fancy color goods.

Colored gemstone prices have also been dynamic, showing market watchers an uptick in their values lately. Something is driving these recent developments besides their intrinsic beauty.

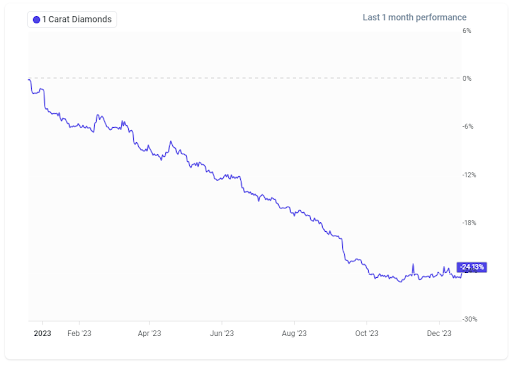

Diamond Decline

The Diamond Registry (TDR), a leading pricing source for diamonds, observes this. "The diamond industry has experienced a significant decline in prices, with a decrease of 18% from their peak in February 2022. According to the Global Rough Diamond Price Index, diamond prices have fallen by 6.5% year-to-date, signaling a continued downward trend."

Natural diamond prices declined in 2023 (Source: Briteco)

The LGD, or lab-grown diamond invasion, upended the natural diamond brand by confusing consumers. They were thinking they were getting a 'sustainable real diamond', and that it had value, like genuine diamonds. While this inaccurate marketing message turned out to be false, the natural diamond sector is left to straighten things out and resurrect its good name.

In a Class of Their Own

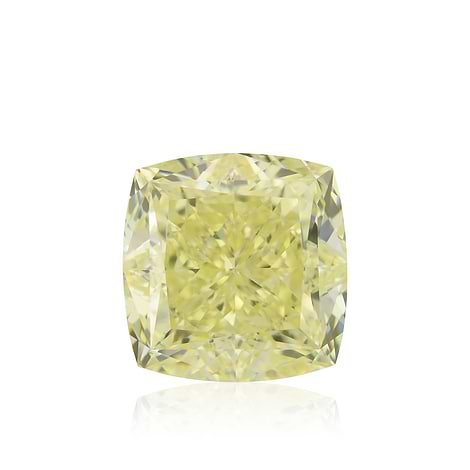

Fancy color diamonds are a completely different story. While colorless diamonds are relatively plentiful, color diamonds are a rare freak of nature.

The FCRF (Fancy Color Research Foundation) puts the relative rarity of color diamonds into perspective. Out of 33 million rough carats recovered, on average, only "fragments of a percent are fancy color diamonds," it says. Most of those will never go through GIA labs for grading. They are simply too small. Diamonds that do make it through the grading process, according to FCRF, represent about 3% of all rough submitted to GIA labs.

This acknowledged rarity within the fancy color diamond world had kept prices for these goods stable or even surprising auction houses with spirited bidding driving the prices beyond expectation.

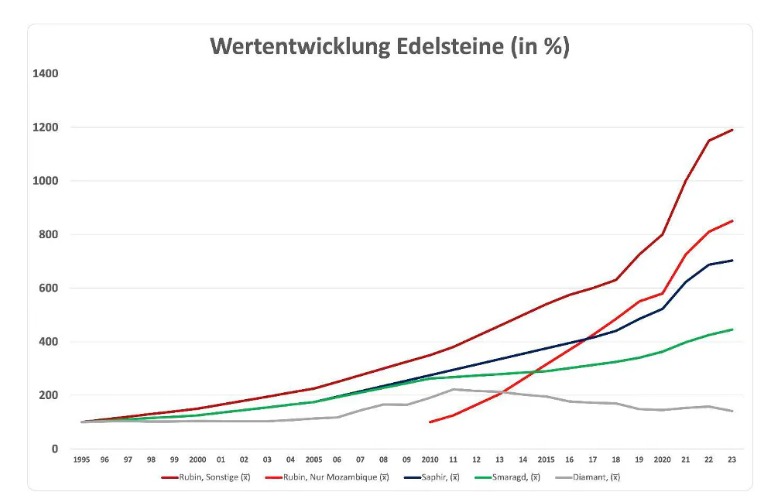

Colored Stones Move Up

The market is simultaneously witnessing price rises in the colored stone world—particularly within certain species. Key to discovering what's for sale and for how much is the annual Tucson GemFair. This year, colored stone pundit Stuart Robertson, president of Gemworld International Inc., shared the current mood. Right now, he explained, there's simply not enough good material to help ease prices downward.

Citing decreased production levels that have remained low since the height of the pandemic, he offered insight through National Jeweler (5.22.24). "If anything, prices will hold stable, possibly even continue to move up in [fine and extra fine quality] categories, because there just isn't the production to support any negative movement."

Meanwhile, National Gemstone, a forecaster's coalition, details these pricing trends. Their 2023 summary highlights the winners and losers (colorless diamonds) from last year. "Vivid and Intense pinks were up 10-12% and yellow diamonds were up by 4%."NG also outlines the list of top-colored stones that have increased in price. The reason is a lack of top quality fine goods in sizes buyers want. "Burma goods continued their assent as no new goods have been mined or sold in Burma (Burma ruby, Burma sapphire, Burma spinel) in at least four years. Clean, untreated no oil Colombian emeralds are in strong demand.

Brazilian Paraiba prices has become almost irrelevant. These electric stones continue their parabolic rise because of incessant demand and no supply. Even the Mozambique Paraiba is closing in on the Brazilian prices. Finally, Kashmir sapphires sell for 300-500% more than Burma sapphires because they are practically nonexistent."

What to Expect

The Financial Times recently offered an additional explanation for the color stone price increase. They noted simply that consumers are taking a shine to earth-mined colored gems as they pivot away from their disillusionment with lab-grown goods.

This mindset will keep consumers shopping for natural-colored stones (especially in bridal jewelry) that are more affordable than diamonds in the same size categories.

Seen in Mining.com's "What to Expect in 2024", "A moderate recovery in both rough and polished [diamond] prices is likely this year. Price gains from seasonal restocking early in the year will probably be modest, as supply that was held back late last year is sold."

We’d like to note that the market in unique colors and nice makes is oversold now. So we are constantly on the hunt for fine goods in Intense and vivid colors. There’s a major shortage for vivid and intense yellows over 2 carats.

A top color vivid yellow emerald cut sold recently at Christie’s toppling its pre-sale estimate.

This emerald-cut, 6.09-carat, fancy-vivid-yellow, VVS1-clarity diamond ring with white diamond accents by designer Cauet more than doubled its $350,000 high estimate to bring in $793,800. Sold at Christie's New York.

Where Are They?

The market for vivid blues is white-hot now.

We just finished an exceptional pair of vivid blue radiants in 1.30+ carats, VVS—VS, perfectly matched in size, shape, and color. That’s a rare combination.

LEIBISH Pair of Vivid Blue Radiant 1.30+ct VVS-VS each

LEIBISH Pair of Vivid Blue Radiant 1.30+ct VVS-VS eachToday’s diamond market can be compared to that charming, lively chameleon.

It can completely change its color quickly right before your eyes---all according to its mood.

My mood is also quite optimistic. I predict the jewelry market will continue recovering and exhibit an infectious positive mood that will spur our industry to return to its former dynamism. LEIBISH Cushion Mozambique Ruby and Diamond Double Halo Ring

LEIBISH Cushion Mozambique Ruby and Diamond Double Halo Ring

LEIBISH 0.65 carat, Fancy Vivid Blue Diamond, Pear Shape, VS2 Clarity

LEIBISH 0.65 carat, Fancy Vivid Blue Diamond, Pear Shape, VS2 Clarity