When ALTR (a created diamond company) exhibited a 3.99 carat lab-grown pink diamond at Borsheim's, they dubbed it, “The Pink Rose” claiming it retails for about $110,000 USD.

The company's mission statement declared that they "employ proprietary technology to replicate the conditions whereby diamonds form in nature. ALTR creates certified Type IIA, lab-grown diamonds that are identical to the chemical, optical and physical compositions of the world's finest mined diamonds."

4.04ct Fancy Pink Center Stone offered by LEIBISH

Of course, man-made pink diamonds create some buzz. The hook is that lab grown pink diamonds provide a bold look for a small price tag. Still a lab created pink diamond ring should cause a budget minded shopper to consider the whole story, not just the attractive price.

Conversely, a 4.04 carat, Natural Fancy Pink diamond from LEIBISH.com retails for $1.7M USD. This stone created by Mother Nature was mined by man in South Africa. If both stones are really the same, why is there such a huge discrepancy in price? Maybe I am missing something here...

Some years back, I bought a fake Rolex on the streets of Hong Kong. This beautiful watch looked identical to an authentic Rolex, and for $35 it looked like a $15,000 watch.

At the time I was very proud of myself, but as soon as I returned home the watch quit working. I took it to my local watchmaker for repair. He took one look at it from across the counter and explained that there was no point in fixing it. He asked me, "why do you get taken in by such gimmicks?"

It got me wondering, are lab-grown diamonds a gimmick, as well? Will they devour the market share of real, natural, mined stones?

One day, while sitting in my office happily enjoying the day and going about my business, an unexpected visitor arrived. This man was a builder, having done extensive work for us in the past. He pulled a ring out of a fancy jewelry box which contained a 5 carat diamond. It looked quite pretty, but I smelled a rat.

"I want to sell this ring," he said quietly. "I am sorry, but the ring is not for us," I replied.

Refusing to take no for an answer, he pressed me to at least look at his ring and give him an evaluation. "Sorry. my friend,” I countered. “We can't provide evaluations on stones not purchased from LEIBISH."

"But we’re friends for over 20 years," he pleaded. "Please take a closer look."

We removed the stone from the setting and gave it an in-depth examination. Quickly it became clear that this was not a real diamond. "How much did you pay?" I asked him.

He started to talk around the question but finally spit it out. "Someone owed me $20,000 for construction work. And when he couldn't pay up, and after prodding him, he gave me this ring, assuring me that it was worth $30,000."

I handed him back the ring, quietly hoping that he would go away without needing to hear the bitter news that his ring was actually worthless. Once the genie comes out of the bottle we cannot put him back in again. I had no choice but to tell him that his ring was worthless and that he got scammed.

He nearly fainted.

LEIBISH Extraordinary Fancy Light Purplish Pink Cushion Double Halo Diamond Ring

LEIBISH Extraordinary Fancy Light Purplish Pink Cushion Double Halo Diamond Ring

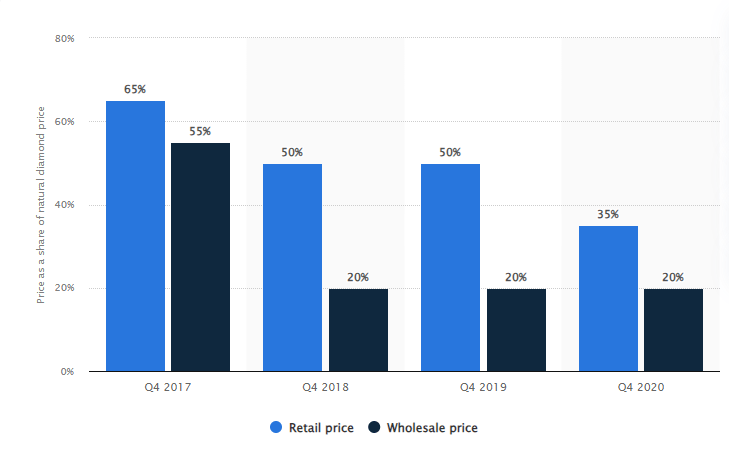

The biggest problem with lab-grown diamonds is that they have no retail value. Once you purchase the stone, that’s it.

Since the closing of Argyle mine, the prices of natural Argyle diamonds have skyrocketed while prices of lab-grown diamonds are plummeting. De Beers jumped in the fray offering their Lightbox brand of lab-grown diamonds at a fraction of the current synthetic diamond price. It won’t be long before all synthetic goods become totally worthless.

So what is the point of fooling people? If everyone claims that natural, mined diamonds have the identical chemical composition as lab grown stones, then why is there such a huge price gap between lab-grown and natural stones?

“Labs”—actually factories, manufacture created diamonds continually—all day long. Genuine earth mined diamonds, especially pink ones are a very rare occurrence---generating a global excitement.

Today you can find authentic, natural Bulgarian rose oil on Amazon in a 2.3 ml bottle for $55, making the cost of 1,000 ml roughly $2,400. But you can also buy synthetic rose oil which is created with the identical chemical composition for $65 per 1,000 ml.

How can there be such a huge price difference? You see why I am getting confused?

If it is the "same", then why is the natural oil worth 35X more than its synthetic version?

Well because, it is just nearly the same... Perhaps an uneducated laymen cannot smell or detect the difference between the natural Bulgarian rose oil and the synthetic one. But don’t be fooled. There is actually over $2,000 in differences.

LEIBISH Pink and Green Diamond Pendant

At an important Argyle Tender, a 0.67 carat natural Fancy Red diamond sold for approximately $1M. A real diamond. Not man-made—but rather a small natural stone under a carat for one million dollars.

DeBeers has now introduced their own brand of lab-grown diamonds, Lightbox, into the market based on their theory that it would reduce the price of lab grown diamonds, thereby, making them the leading authority in the field.

This reminds me of the Hunt brothers who tried unsuccessfully to corner the silver market and control the price of silver. But actually the opposite happened.

Nelson Bunker Hunt and his brother William Herbert Hunt, sons of Texas oil billionaire Haroldson Lafayette Hunt, Jr. (1889-1974) had for some time been attempting to corner the silver market.

In 1979, the price for silver (based on the London Fix) jumped from $6.08 per troy ounce ($0.195/g) on January 1, 1979 to a record high of $49.45 per troy ounce ($1.590/g) on January 18, 1980, representing a 713% increase. (Excerpt from: https://en.wikipedia.org/wiki/Silver)

The Hunt brothers had borrowed heavily to finance their purchases. But a sharp decline in silver prices ensued. As the price free fall began, dropping over 50% in just four days, they were unable to meet their obligations, causing panic in the world markets. It took a consortium of US banks intervening to sort this out—but not before the Hunt brothers lost a billion dollars in the fracas.

DeBeers' lab diamond marketing move was not well received in the industry either. Trying to lower the prices of lab grown stones looked like a smart move, but De Beers should have first killed the competition.

Really, no one can control the diamond market. First, they shot themselves in the foot by driving down the prices of low grade natural diamonds. This will also reduce the price on lower quality rough from De Beers’ own mines.

When you add meat and potatoes, the soup gets thicker and stronger, but when you add water it just gets watered down or rather, diluted.

.png)