Well, it was good while it lasted, or was it? The LGD party left a heap of collateral damage in its wake, to the consumer who was fed a promise that didn’t pan out—and to the trade who should have seen it coming.

I first sounded the warning alarm about the dangers of LGD back in 2016, at a time when no one paid attention or could foresee the colossal damage LGD would wreak on the diamond brand and to the jewelry industry at large---especially to DeBeers.

I never understood why man-made stones, which 'look like diamonds,' were able to be called diamonds? If the industry had proactively trademarked the word diamond, those artificial stones could never have been called diamonds in the first place.

Looking back at President’s Corner, 2016

[Referring to an article by Dr Cavalieri, president of the World Jewellery Confederation (CIBJO), criticizing comments from Hollywood actor Leonardo DiCaprio, a key investor in the synthetic diamond start-up, Diamond Foundry.]

DiCaprio’s history with diamonds harkens back to his 2006 premiere of Blood Diamonds by exposing the atrocities of conflict diamonds and human rights abuse. Yet, in the 1997 film Titanic, DiCaprio gave a mammoth blue diamond pendant to a beautiful blonde. Today, he’s manufacturing diamond substitutes for profit by claiming they’re sustainable -- an interesting viewpoint from such sweet young man.

I have to admit that the branding of these man-made stones have surpassed the product itself—with claims that 'Lab-created, man-made, synthetic stones are alternatives to mined diamonds, and they are fantastic.'

Yes, claims describe these synthetic stones as "fantastic.” They assert that 'no longer are mined diamonds the only choice for engagement rings and fine jewelry. Eco/ethical concerns, coupled with technological advances, have made alternatives not just acceptable, but preferred.'

The entire sales pitch is misleading. Jewelry made from lab-grown stones will never be 'fine jewelry.' They intentionally omit the key difference between the two -- the eternal value of a natural gem -v- a valueless chemical creation. It may look real at first glance, but don’t kid yourself – it’s a fake.

Expert Predictions

Leading industry analyst Edahn Golan, of Edahn Golan Diamond Research and Data wrote, “The prices of lab-grown diamonds have been declining, with wholesale prices for 1 to 1.4-carat and 2 to 2.99-carat stones decreasing by 60% and 65%, respectively, in 2023. The price of 1-carat pieces is approximately 76% less than that of natural diamonds, 2-carat pieces are priced at about 86% less than that of natural stones.

In an exclusive interview with Rough & Polished Mathew Nyaungwa, Golan predicts the continued decline of lab-grown diamonds, especially at the retail and mid-stream levels with declines continuing until the gross margin of retailers falls to between 35 and 40%. Retailers must rethink their strategies, Golan said, as the portion of their total diamond revenue from lab-grown goods begins to decline.

Since we are fancy color and colored stone specialists, we’re staying focused on our own niche.

LEIBISH Extraordinary Fancy Green Yellow Cushion Diamond Ring

LEIBISH Extraordinary Fancy Green Yellow Cushion Diamond Ring

Commentary from 2018

THE REAL VS LAB-GROWN PINK DIAMONDS

[Referring to created diamond company ALTR’s 3.99 carat lab-grown pink diamond dubbed “The Pink Rose” retailing for $110,000 USD.]

ALTR’s bold mission statement declared they "employ proprietary technology to replicate the conditions whereby diamonds form in nature; certified Type IIA, lab-grown diamonds identical to the chemical, optical and physical compositions of the world's finest mined diamonds."

Sure, man-made pink diamonds create some buzz, especially considering lab-grown pink diamonds deliver a big look for a small price tag. Still, a lab-pink diamond ring should cause a budget-conscious shopper to rethink the entire story, not just its enticing price.

LEIBISH 0.82 carat, Fancy Vivid Purplish Pink Diamond, 3PP, Radiant Shape, SI1 Clarity, GIA & ARGYLE

Conversely, a 4.04 carat, Natural Fancy Pink diamond from LEIBISH retails for $1.7M USD. This rare stone was formed by Mother Nature and mined by man in South Africa. If both stones are really the same, then why is there such a huge discrepancy in price? Am I missing something here?

Fakes Fail

Years ago, I bought a fake Rolex for $35 on the streets of Hong Kong, looking identical to an authentic Rolex costing more like $15,000. I was very proud of myself until I returned home, and the watch quit working. My local watchmaker took one look at it from across the counter and said there was no point in fixing it. "Why do you get taken in by such gimmicks?" he asked.

I started wondering, are lab-grown diamonds a gimmick, too? Will they devour the market share of genuine, mined stones?

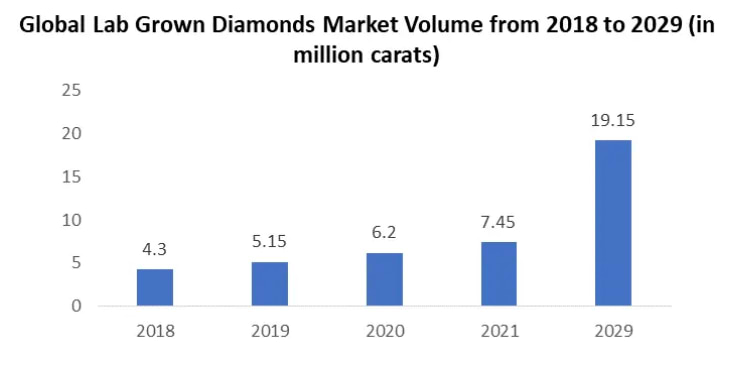

Global Lab Grown Diamonds Market Volume from 2018 to 2029 (in million carats)

Global Lab Grown Diamonds Market Volume from 2018 to 2029 (in million carats)

(Credit: Maximize Market Research)

One day, while sitting in my office enjoying the day I had an unexpected visitor, a builder who had done extensive work for us. He pulled a 5 carat diamond ring out of a fancy jewelry box. It looked good, but I smelled a rat. "I want to sell this ring," he said quietly. "I am sorry, but the ring is not for us," I replied.

Refusing to take “no”, he pressed me for an evaluation of his ring. "Sorry, my friend,” I countered. “We can't provide evaluations on stones not purchased here." He pleaded, "please take a closer look."

We removed the stone from the setting and gave it a thorough inspection. It became clear that this was not a real diamond. "How much did you pay?" I asked. Hesitatingly, he spit it out. "Someone owed me $20,000 for construction work. When he couldn’t pay, he gave me the ring, claiming it was worth $30,000."

I handed him back the ring, hoping he would leave without learning the bitter news. Once the genie comes out of the bottle it can’t go back in again. I had to tell him his ring was worthless, and he got scammed. He almost fainted.

LEIBISH Multicolor Extraordinary Five Stone Band Ring

The biggest problem with lab-grown diamonds is their lack of resale value. Once you purchase the stone, that’s it.

Pink Prices Soar

Since the closing of Argyle mine, the prices of natural Argyle diamonds have skyrocketed while lab-grown diamond prices plummeted. De Beers jumped into the fray offering their LIGHTBOX brand of lab-grown diamonds at a fraction of the current synthetic diamond price. Before long the value of all synthetic goods will become zero.

So what is the point of fooling people? If claims that natural, mined diamonds are identical chemically and compositionally to lab-grown goods, then why the huge disparity between lab-grown and natural stones prices?

Fake is Fake

“Labs”, really factories, manufacture created stones continuously — 24/7. Genuine earth mined diamonds, especially pinks, are a very rare occurrence---generating global excitement.

Today you can find authentic, natural Bulgarian rose oil on Amazon in a 2.3 ml bottle for $55, making the cost of 1,000 ml roughly $2,400. But you can also buy synthetic rose oil with the identical chemical composition for $65 per 1,000 ml.

So why the huge price gap? If it is the same, then why is natural oil worth 35X more than its synthetic version? Truthfully, it’s nearly the same. Perhaps a novice cannot detect the difference between natural Bulgarian rose oil and its synthetic counterpart. But don’t be fooled, the difference is worth $2,000.

LEIBISH Pink Pear & Green Radiant Diamond Drop Halo Pendant

LEIBISH Pink Pear & Green Radiant Diamond Drop Halo Pendant

The Wrong Moves

DeBeers launched LIGHTBOX in 2018, thinking it would reduce the price of lab grown diamonds, making them the leader in that field.

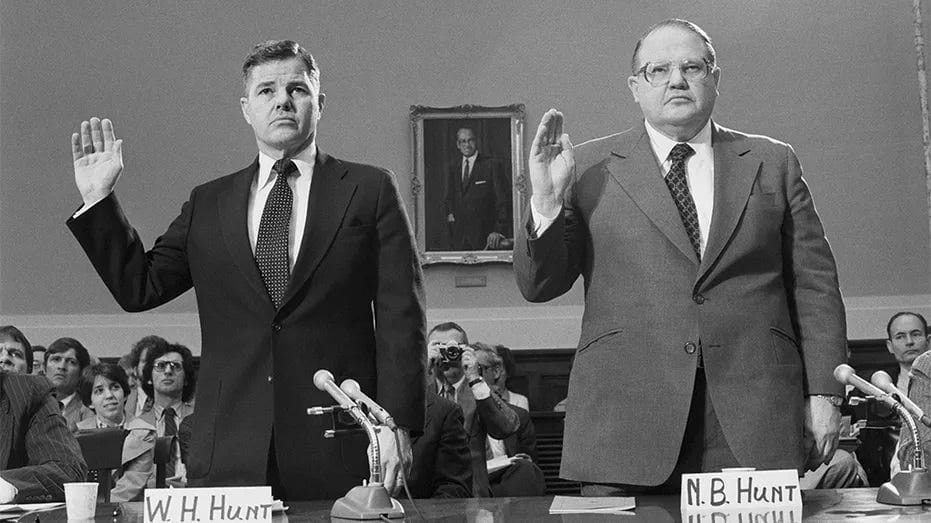

It’s like the Hunt brothers who tried unsuccessfully to corner the silver market and control the price of silver. Actually. the opposite resulted. Nelson Bunker Hunt and his brother William Herbert Hunt, sons of a Texas oil billionaire were attempting to corner the silver market. And In 1979, the price for silver jumped from $6.08 per troy ounce on January 1, 1979 to a record high of $49.45 per troy ounce on January 18, 1980, a 713% increase.

Hunt brothers

The brothers borrowed heavily to finance their purchases before silver prices tumbled. When the free-fall slashed prices by over 50% in four days, they were unable to meet their loans, causing world markets to panic. A consortium of US banks intervened—but not before the Hunt brothers lost a billion dollars in the fracas.

DeBeers' lab diamond marketing strategy was not favorably received in the industry either. They thought lowering the price of lab grown stones was smart, but De Beers should have first killed off the competition. Really, no one can control the diamond market.

What Party?

DeBeers misstepped by driving down prices of low grade natural diamonds which also reduced the price on low quality rough from its own mines. Now it appears the party really is over. There’s no more talking about the luxury appeal of LGD, but instead the collapse of the LGD prices.

.png)