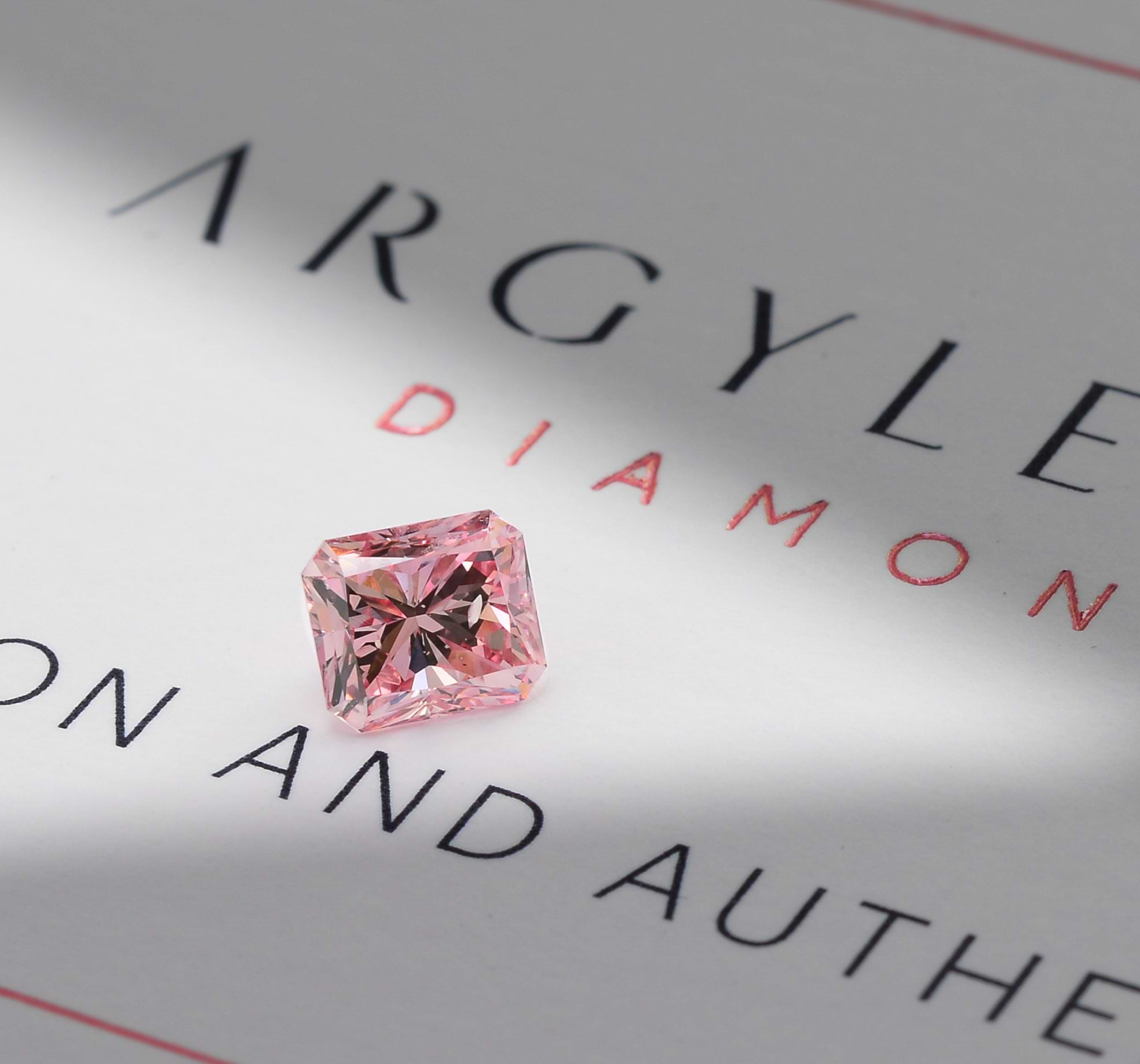

First no one even heard of them. Then everyone did. Pink diamonds have become the darling of serious collectors the world over. Their ravishing pastel hues and lingering mystique holds sway over the most sophisticated of investors.

As fascinating as natural fancy pink diamonds are, their place of discovery is equally engaging. Over 90% of the world’s supply of fancy pink and red diamonds hails from the remote seemingly barren landscape surrounding the Kimberly region of Western Australia. Nothing was there, except the world’s most sought-after stones. To reach the area, indigenous workers commuted over 1,200 miles from Perth to reach the mines. Investors have kept these lavish stones on their short list for some time.

Unique Geology of Argyle Mine

Geological evidence of volcanic activity pointed to this vast terrain being diamond rich. It became known as Argyle Diamond Mine and the 4th largest diamond producer by volume in the world during its heyday. In its most productive year in 1994, the mine yielded 42 million carats.

To everyone’s amazement, most of the gem-quality production yielded brown rough. Today we call them champagne, or brown, even cognac diamonds. Clever marketing turned these previously overlooked stones into must-have-diamonds of the late 1990s.

What they didn’t need help selling were the pink, purple, red, and even blue crystals coming from this deposit. They were mesmerizingly gorgeous straight from the ground. Pinks in particular were so captivating that the diamond buying public quickly became enthralled by them—and the fervor has never cooled down.

Now, after nearly 40 years of robust production, the mine is silent. The workers have gone home. Argyle’s charmed story now belongs to history. November 2020 saw the last rough coming up from the mine which gave us thrill after thrill each year for decades.

A Private Sale Everyone Wants to Attend

Every year Argyle held a special tender—an invitation only private sale of their finest pinks and reds. Few dealers were privy to the elite offering which operated by sealed bids. Color diamond specialist Leibish Polnaur, founder of LEIBISH, has been on Argyle tender’s exclusive short-list for years. The last 2 sales were unique, however. After 37 years of production, it became untenable to continue, something that was expected to happen. While it wasn’t a total surprise, when the end came, dealers and collectors realized they were witnessing the last of these timeless works of art, never to be replicated.

Acquiring the Last of the Last

Knowing this was the end of an era with no other region producing pink diamonds made the last 2 sales both melancholy and highly anticipated. “We bid on all stones, since the goods will become super rare, in high demand, and expensive,” reflected LEIBISH executive Shmulik Polnauer at the time. Polnauer estimated that asking prices for 2020’s tender was 15% higher than the previous year. So, LEIBISH upped its bids “20% and more”, ensuring the company secured lots. That bold move resulted in 16 of the 62 most alluring pink and red diamonds going to LEIBISH. They acquired 50% of the 1-carat dazzlers, more than any other buyer.

LEIBISH struck with the same focus and determination at Argyle’s final tender. Acquiring more pinks and reds provided the company with expanded opportunities to satisfy their investor’s appetite for these scarce beauties. Feeling the time was right, LEIBISH debuted their finest red stone, the Red Dragon Diamond from the Argyle Pink Diamonds Signature Tender, 2020. A 1.09ct Fancy Purplish Red Radiant, the prized diamond exhibits exceptionally rare VS2 clarity.

“It’s difficult and painful to reconcile with the fact that the Argyle mine, Rio Tinto, has closed,” said LEIBISH founder Leibish Polnaur. “Forever. It’s like parting with an old friend of 30 years. I’m deeply saddened that we won’t ever meet again.” he admits.

Given this stark reality, diamond collectors and investors have dealers like LEIBISH to thank for having the foresight to carefully curate the finest pink diamonds for connoisseurs who realize there’ll be no more.

A New Source? Not Really

A few weeks back, trade journals reported the discovery of a pink diamond at Finland’s Latuoyueji Diamond Mine (Lahtojoki). It’s the first important diamond mine outside of Russia, claiming a proven reserve of 2.25 million carats (in 2017) with an estimated mining life of 9 years.

The fanfare is exhilarating, but is it hype or is it news? “First of all,” Polnaur points out, “the images appearing in the Lahtojoki pink diamond report are actually Argyle pink diamonds from Australia. It’s entirely misleading to compare a diamond sampling from Finland, to those from Rio Tinto’s mega-sized operation.” So far, it does not measure up to the illusion of the few stones they’ve extracted from the first sampling, Leibish points out. “It’s a move to try to raise capital and drive up the price of the penny stock,” Leibish sees.

Investors Bullish on Fancy Diamonds

Statistics reveal an historical price uptick for diamonds from 2010 -2020 of about 45%. Fancy diamonds fared even better. In 2020, Covid-19 unexpectedly opened new channels for introducing us to new clients who never dreamt of spending 100K or more with a virtual vendor. Today it’s a commonplace occurrence.

Covid-19 created the perfect storm for investors and connoisseurs to ramp up their acquisitions of fancy pink diamonds. While all fancy colored diamonds soared in price over these last two years, fancy pinks have shot through the roof. The reasons are pretty straightforward. The closing of Rio Tinto’s Australian Argyle mine permanently shut the door on acquiring any more natural pink diamonds. This reality made serious investors redouble their focus on Argyle’s pink diamonds. There is really no alternative for Argyle’s extraordinary pink and red stones. Investors looking for a pink diamond know Argyle diamonds are still their best option. ▼

.png)