LGD’s Magnificent Downfall

LUSIX, a pioneer in the rough lab-grown diamond (LGD) manufacturing sector, was founded in 2016 by Israeli entrepreneur Benny Landa, who had previously sold his digital printing company for $830 million.

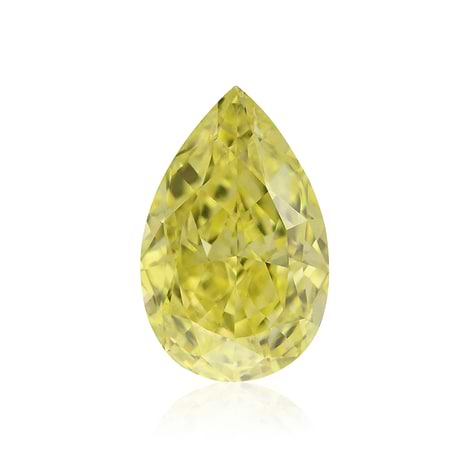

Today, LUSIX and its so-called Sun Grown Diamond brand are facing a severe financial crisis. LUSIX’s downfall is largely due to the plummeting prices of raw lab-grown diamonds, which have dropped from their previous high of $300 to a recent low of $30 per carat.

Without a substantial cash injection, LUSIX has stated it will become insolvent.

The company has cut a significant portion of its workforce, implementing unpaid layoffs while temporarily shuttering its production plant.

Hoping Against Hope

Once a leader in the field, LUSIX promoted itself as the producer of Sun Grown Diamonds.

Now, with its insolvency, LUSIX’s downfall highlights the magnitude of its miscalculation about the LGD industry.

Big Players

In 2020, LUSIX raised nearly $100 million. A key investor, LVMH (Moët Hennessy Louis Vuitton), is said to have contributed only $1 million.

However, the association with LVMH gave other potential investors the false impression that LGDs were being embraced by all luxury brands.

That investment was spearheaded by Frédéric Arnault, the son of Bernard Arnault, Chairman of LVMH.

Frédéric became CEO of Tag Heuer at age 27 in 2020 but has since been succeeded by Julien Tornare.

LVMH did not introduce LGDs to the conglomerate’s other brands, and the once-promising story of LGDs has now been unceremoniously buried, resulting in a $100 million loss for LUSIX investors.

Then the Truth Came Out

Initially, the music hadn’t yet stopped. Jewelers made astronomical profits selling LGDs while simultaneously undermining their bread-and-butter item — the natural diamond.

But the reality of LGDs’ worth, or lack thereof, caught up quickly within the luxury sector. In just two short years, LGD prices deflated by a staggering 90%.

The watch industry did not embrace the LGD trend once consumers realized these man-made stones were simply worthless imitations. Luxury goods consumers only want the real deal.

This Really Happened

Let me tell you a true story. Not long ago, a client in Colorado walked into a luxury retailer with $60,000 in his pocket, looking to buy a 3-carat F/VVS round brilliant diamond for his wife.

The salesman could smell that $60,000 sale, but margins on a 3-carat F/VVS with a GIA certificate were only 12%.

The client was holding a Rapaport price list, so he negotiated the price down. Then the salesman had an idea and turned around, pulling a different stone from the drawer.

“I’ll give you a great deal you can’t refuse,” he said. “I have a real LGD with an Antwerp IGI certificate showing this stone to be an F/IF.

I can offer it to you for $24,000, including a solitaire ring.”

The cost of that 3.00-carat LGD was less than $2,400, including the setting and presentation box.

You don’t need to be a mathematician to see that a profit of $21,000 on a $24,000 sale is an unbelievable windfall.

The insane dream that these fake diamonds would overtake the place of authentic earth-mined diamonds never materialized.

Now, you tell me, what happened next?