One thing the most recent recession has taught us is that while stocks and bonds can be the door that leads to one’s financial security, it can also be the door that suddenly slams shut, locking all finances away for good. The instability of the market has lead investors to search elsewhere for wise and worthwhile opportunities.

Precious metals and stones such as gold and colored diamonds are two of the hottest options available for potential investors. Both of these commodities have proven successful and safe as investments over the past forty years. Here is a look at why these items have done so well despite the poor economy and speculations regarding what the future may have in store for them in terms of their value. Choosing to invest in diamonds or gold depends on various factors, let's delve deeper into this decision.

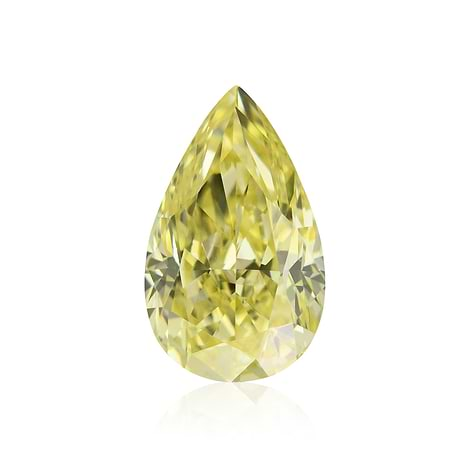

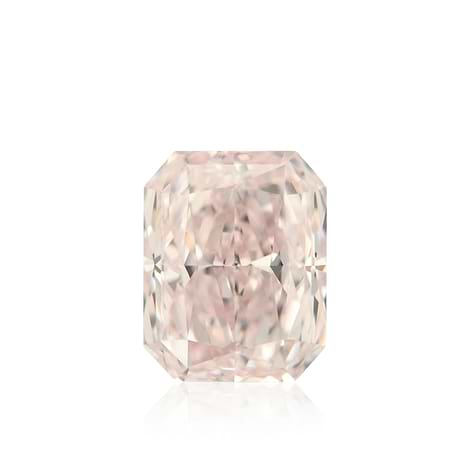

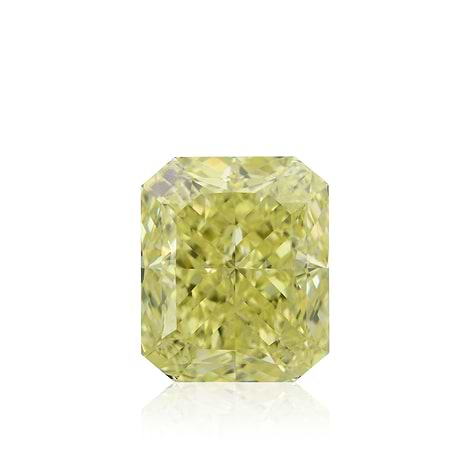

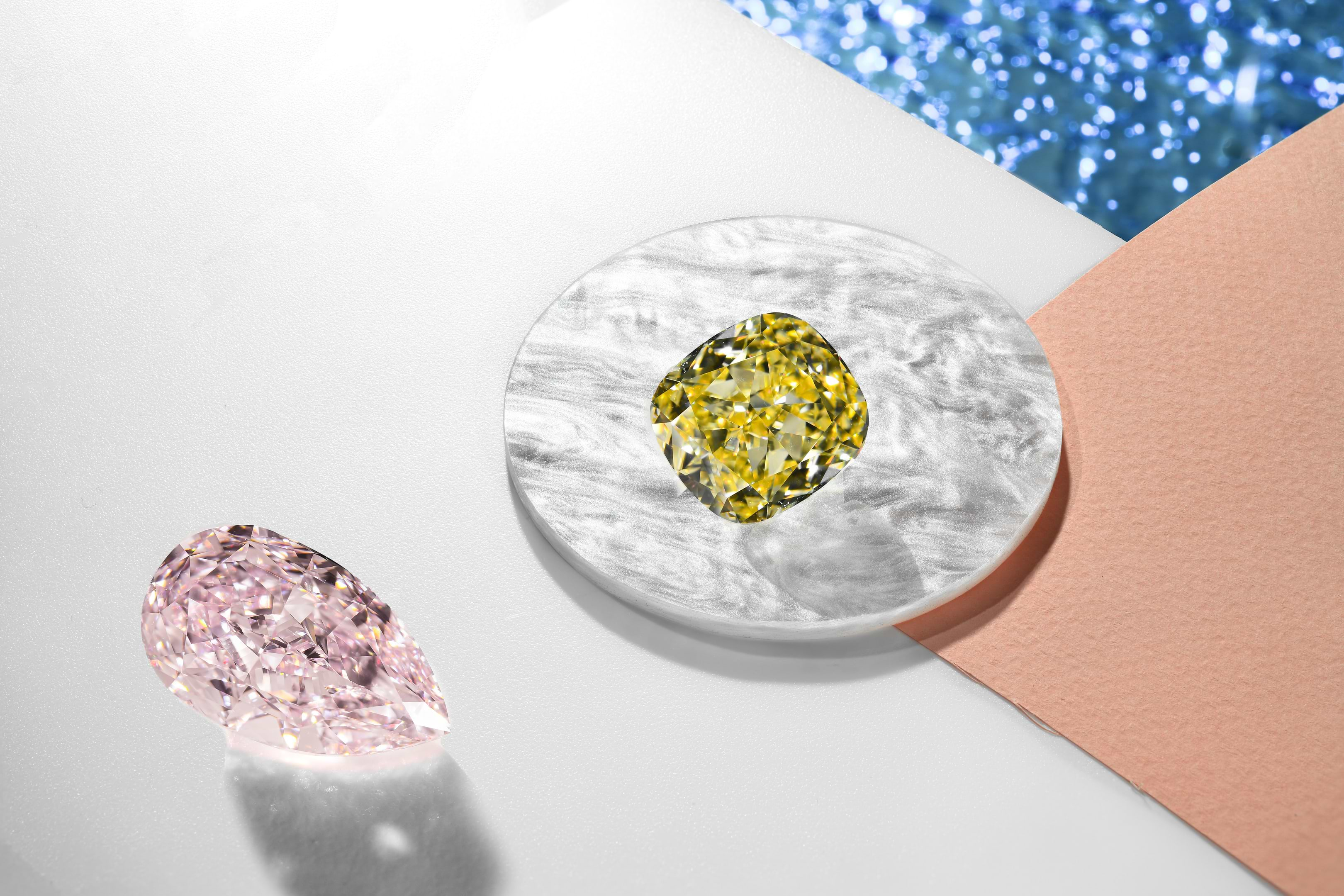

LEIBISH Pink and Yellow Diamonds

LEIBISH Pink and Yellow DiamondsGold has been valuable and used as a form of currency for centuries. Its beauty as well as unique characteristics have been acknowledged and appreciated by men and women alike, whether acquired for the purpose of an investment or to be used as jewelry. However, when purchasing enough Gold to invest, you don’t actually take hold of the goods. Rather, you acquire ownership on paper. In the time of need, whether an emergency or natural disaster, most prefer to actually have their investment in their own possession.

Furthermore, Gold has fluctuated up and down quite drastically over the past ten years, but overall moved in the right direction. It most defiantly is its own commodity, but it is directly connected to the world economy. The fact that these precious metals are stored by banks, it is impossible to know what is going to happen with your investment.

Unlike gold, colored diamonds have only begun to grab attention of the investment world recently, at the beginning of the 21st century. Nevertheless, colored diamonds do have a rich history, as they have been worn and purchased by royalty and the higher classes for some time.

Though they have always been rare, colored diamonds are even rarer today as a result of their growing popularity and high demand. The sources for colored diamonds, particularly certain colors, are extremely limited. Between the low supply and high demand, the prices are forever soaring. This is precisely what makes this commodity and excellent investment, and it is only one of the many appealing reasons.

White Diamonds vs. Colored Diamonds

White diamonds differ from colored diamonds in a number of ways, and not just in color. The consumer, alone, is the decisive component in a white diamond’s value while a colored stone’s rarity and potential high bids at auction houses are what ultimately determine colored diamond prices.

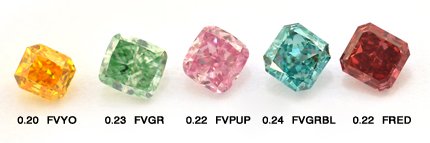

Extremely rare diamond such as red and blue diamonds most certainly demand high prices, but even “more common” colored diamonds such as brown and yellow diamonds account for less than 0.1% carats of white diamonds that are found.

Prices at auction houses are constantly increasing, so much so that natural fancy colored diamonds from the year 2007 to the year 2012 broke a total of thirteen price records. The solid rate at which colored diamond prices are rising legitimately removes colored diamonds from the “risky investment” category that many are distancing themselves from in light of the collapsed economy.

LEIBISH Argyle Fancy Intense Purplish Pink Diamond Couture Ring

LEIBISH Argyle Fancy Intense Purplish Pink Diamond Couture Ring

Easy to Move, Easy to Store

Yet another advantage to investing in colored diamonds as opposed to gold for instance, is its weight and ability to be moved with great ease. If one chooses to invest in a physical item and not a company’s stocks, there is quite a range of options to choose from. However, if one would like that object to be easily protected and moved, the choices taper significantly. Unlike, say, a valuable painting, a colored diamond can be transported easily.

The amount of gold equal to a valuable colored diamond cannot be moved quite so easily. Large amounts of gold are usually not even stored on an owner’s property, but rather, in a bank. A colored diamond can be stored or hidden in one’s home, safe, or even worn on their finger.

Liquidating Colored Diamonds

One of the most important aspects of an investment is how easy it is to liquidate. Gold is fairly easy to liquidate, thanks to modern technology. It can be sold and money transferred with a click of a mouse. Though selling a colored diamond is slightly more complex than that process, a rare and high quality colored diamond is worth the wait. Similar to a piece of art, or sought after piece of land, the sale may take time, but the high rewards are much appreciated.

|

|

Flaunt your Diamond

The best part about acquiring a colored diamond as an investment should be quite obvious. A colored diamond is, after all a colored diamond! It can be worn in a variety of ways and displayed before everyone. Of course colored diamonds should be insured, but that is the case with any valuable item. The difference is, there is nothing exciting to be done with piles of gold. Yet a stunning pink diamond pendant can adorn you every day while ensuring that not too far down the line it will be worth much more than its cost.

|

3.30 Carat, Fancy Orangy Pink Diamond Ring |

While there is not much to know about gold, it is either certified or not, there is quite a lot to learn about colored diamonds. This should not steer you away from the fantastic investment opportunity that a colored diamond offers you. This, along with the other aspects of a colored diamond, is just part of bringing a remarkable natural specimen into your belongings that is much more than a boring asset, but an intriguing stone that has many facets, in more ways than one.

Colored diamonds are not only long term alternative investment options but they are currently the world’s strongest long term alternative investment options that also provide you with beauty, fascination, along with many other advantages.

More Stats and Info

The US stock market is on life-support, and has been for quite some time. It will depend on the actions of the Fed and other Central Banks throughout the world to save our financial system from crumbling. While Bernanke's recent statements and testimony before Congress was somewhat disappointing to those hoping fervently for a hint that QE3 was just around the corner, the hope is still alive.

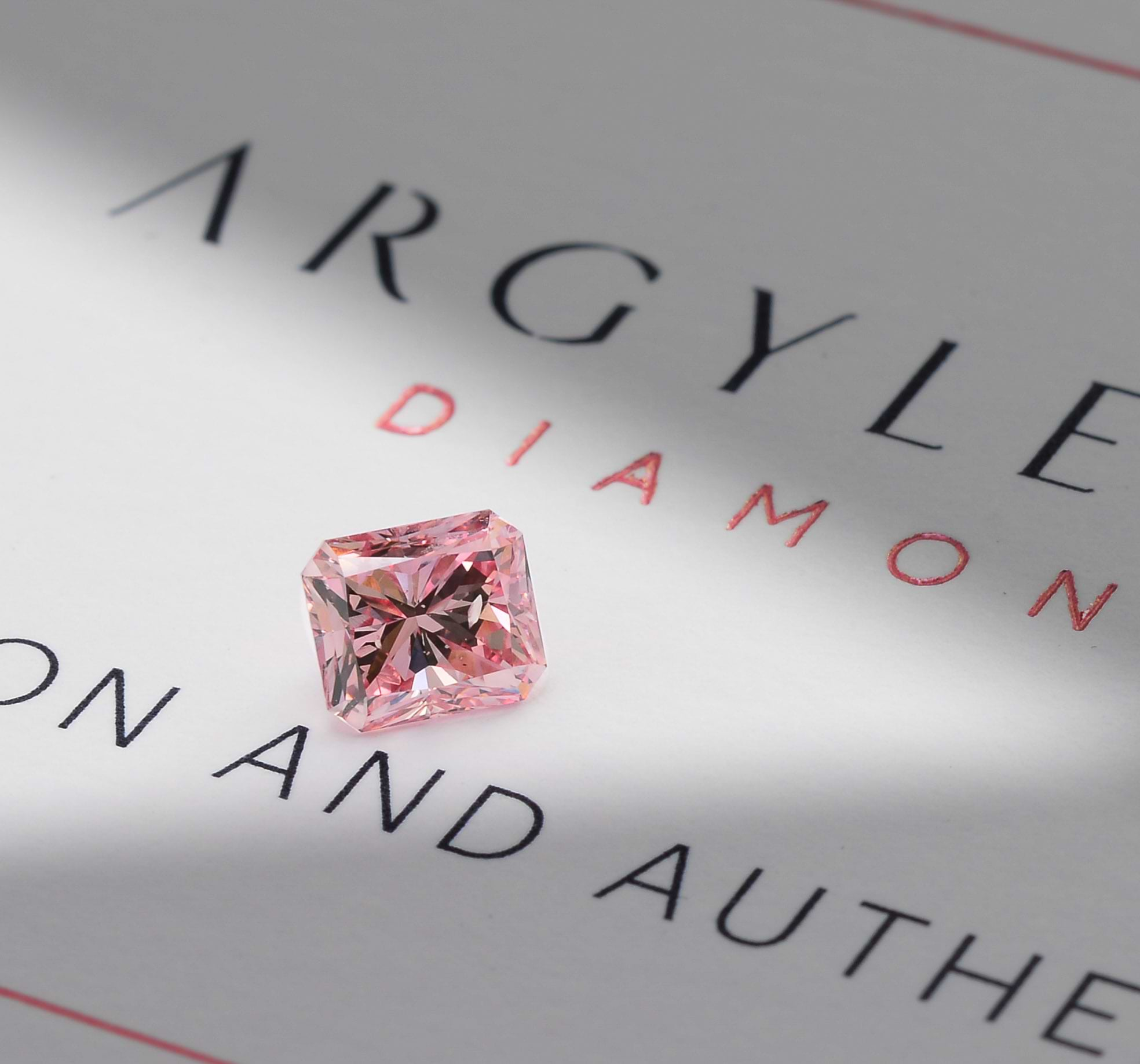

The world we live in is full of some amazing natural resources such as Argyle Diamonds that prove to be a safe haven for investors. Just because the US economy has seen better times doesn’t mean a promising future is hopeless.

The Rapaport historical price graphs below show statistical data over a period of the last 10 years that prove the strength of Fancy Color Diamonds compared to other major assets in the market, such as Gold, Platinum, the DJIA, and Colorless Diamonds as well.

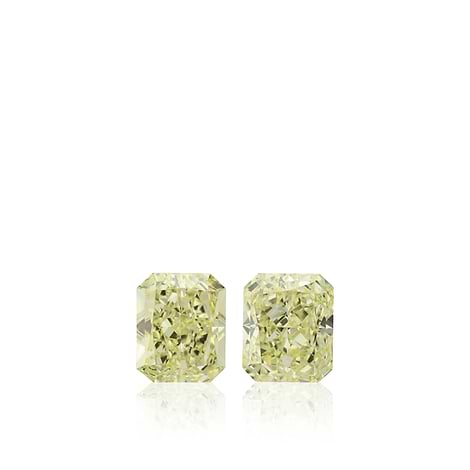

Many of LEIBISH’s respected private clients have questioned whether Gold or Fancy Color Diamonds are a good and safe alternative for long term investments. ‘Fancy Yellow diamonds above 2.00 carats with an IF clarity grade’ and ‘Argyle Pink diamonds above 0.50ct in any clarity grade’ are only some of the stones highly recommend to retain and increase in value over the next 10-15 years. However, there are many different opinions on the matter by some of the most well respected financial institutions we have had the pleasure of working with.

A collection of a number of the finest color diamonds that all make sound investments

Julian Sinclair

Chief Investment Officer at Talisman Global Asset Management Limited

Gold - our view is that it works in times of great expectations of lots of inflation or lots of deflation (a bust) but in the "interregnum" is just an asset to trade vs. Fiat money (i.e. USD). We reduced our exposure in the 1600/1700s for what it’s worth.

David Young

Owner of Wexford Capital Management

In 11 years time, Gold has appreciated by 473.7% and silver by 515.3%. Regardless of what it has done over the last 5 months; gold and silver hit new 30-year highs in 2011. Consolidations always take longer than expected. Try $5,000 Gold and $160 Silver on for size and see where buying even today after 11 years of a bull market would put an investor!

Richard Gless

Chief Compliance Officer of Royal Metals Group

I say both as any good diversified portfolio as we have no idea how things will play out. I prefer colored diamonds to store my wealth and gold and silver to barter with as they are easily recognizable and can make for an easy transfer for small barter transactions.

For those, including myself not trusting of his Govt. I want to encourage my agents and advisors to diversify their clients into natural colored diamonds. Both will do extremely well in a massive inflationary environment. Deflation is only temporary then you will get the massive inflation and then hyperinflation.

I like Fancy Color Diamonds the best out of any asset class due to its Portability and Privacy. Advisors who miss FCD are doing a disservice to their clients.

They say “different strokes for different folks.” Meaning, everyone will go with what they feel fits best. Leibish Polnauer, President and Founder of LEIBISH Fancy Color Diamonds, explains why he feels when comparing some very strong alternative investments, why he sides so strongly with color diamonds.

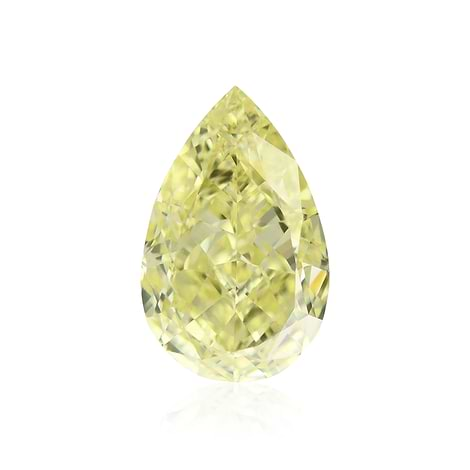

LEIBISH 5.14ct Fancy Light Yellow Diamonds

LEIBISH 5.14ct Fancy Light Yellow Diamonds

"I look at our 0.53ct Fancy Red GIA VS1 Argyle diamond vs. the other option of Gold. The stone is worth just below $400,000 US. It fits in your shirt pocket and can easily be transported and remain on your possession in the time of need. One can wear it in a ring or pendant and enjoy every moment of their investment while not reducing the value because it is in use. There is no need to report the price increase in your yearly statements and nobody will notice how much value it has. If you spend $400,000 US and buy Gold bars, you or your bank is forced to report each year how much your gold is worth."

One day the cash strapped US government may decide on a Gold Tax, a new Capital Gain Tax, or any other tax- you name it.

Your red diamond is a rare commodity, with an Argyle Number and GIA VS clarity grade. You can buy and sell gold with a click of a finger- but with the right tools you can mine more gold as much as you want. Color diamonds are very different. They are rare and extremely unique! More can and will be found, but stones like this are one in a million.

A question frequently asked by clients that call in, is what is the liquidity of fancy color diamonds? People want to know if the stone they purchase will be resalable and if they will be able to turn it back over to cash when the time comes.

LEIBISH Fancy Yellow and White Diamond Pear and Oval Drop Earrings

LEIBISH Fancy Yellow and White Diamond Pear and Oval Drop Earrings

One who has Gold, Bonds, or Stocks in their portfolio can quite easily liquidate them in an instant with the push of a button or a single telephone call to the bank. Liquidity of an investment is important, but it should not be the absolute decision maker.

A gorgeous piece of prime land in New York City or Sydney, Australia is worth a substantial amount of money and translates to excellent investment property. Similarly, those looking to sell an important impressionist painting, like those often auctioned off at Sotheby's in Geneva, can often expect a rather high return on their investment. Only, in order to sell a painting or a Pink Diamond, one needs a professional network at their fingertips. These are the types of long-term investments that are worth adding to a portfolio even though it often takes more than a mouse-click to liquidate.

Furthermore, LEIBISH is always interested in assisting one to resell their Leibish branded diamonds or diamond jewelry for our clients. Some goods they will actually purchase themselves for their own stock and some they will consider putting up on their site to resell on behalf of the customer.

Long-term investment assets are not as easy to liquidate as stocks. Still, they are extremely powerful and for good reason! Diamonds are forever, and some colors more than others will remain a very wise investment.

If you are in a hurry, fancy color diamonds are not for you. Rather, keep you money in the money market. However, if you are planning for the next generation or for the future of your family - Fancy Color Diamonds should be part of your portfolio.