For some unknown, when it comes to the color diamond business, some people think of me as a Guru. Let me be straight with you, it is sheer nonsense. But, you tell me; how can a man fight admiration?

When I put on my branded off-white hat, it appears I radiate some type of authority.

Selfie of Leibish in his branded hat

In the beginning I tried to protest, but it didn't help. My friends would say "you know the game and always seem to see what’s coming! You built a website 10 years before anyone else. Today, you are the king." I don’t have a suitable answer on this powerful nonsense, so I accepted my Karma - my new role as a Color Diamond Guru. Even our own continent manager calls my monthly newsletters ‘Papas Gems of Wisdom.’

People usually grow into a challenging position. I comforted myself by saying that maybe I will find something really smart to say later on in the month. I give out advice generously, and I enjoy it. Needless to say, sometimes I am also wrong, but none the less I offer my opinion where I can. So, allow me to teach you a few elementary concepts about the diamond business. I will stick to the basics, but explain what could be madly fragmented and challenging.

Three words are governing the trade, even in India. All three are in the Yiddish language.

Mazal - the signature word on concluded business. Whether you already paid or not, upon the word of Mazal, the deal is done. Regretfully, the payment does not always follow the word anymore and the deal evaporates. The Mazal today is not really final as it once was.

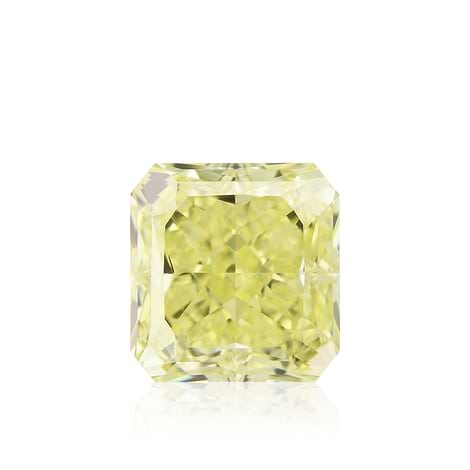

Meziah – the word of a powerful bargain. It describes when one finds a diamond which is worth a lot more than what they paid for it. No one can challenge the value of a Meziah. In fact, the word has Talmudic origin, ‘a found item.’ But in the diamond industry it refers to an article for which you are praying for a big bargain. It is a desirable stone with huge discount. Shmulik, our GG GIA chief buyer is master of finding these bargains.

Shmulik loupes a diamond

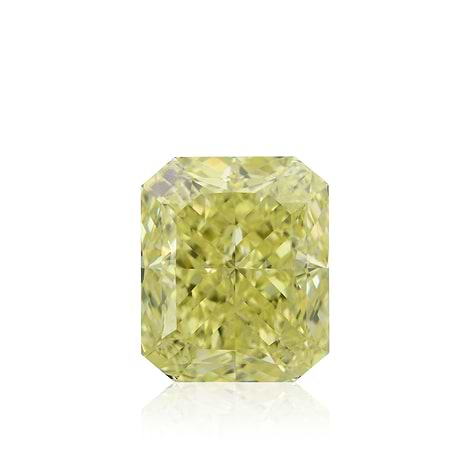

Strop – the term used to describe the opposite of a Meziah. This is an article for which you overpaid, madly. A stone which is worth only a fraction of the price you paid. These, since the purpose of the business is the profit margin, will likely stick with you for a long time.

With these three words, and a lot of cash, you can start to navigate your way in the diamond industry. But, you have to be careful! Too many have tried to get into the diamond business and designated sometimes large budgets. However, if the wrong move is made, it hurts. Mistake can always be made. It can be anything from buying a stone from someone within the trade, dedicating $5 million towards establishing a diamond fund, or even purchasing a large black diamond for $5,000 dollars off a soldier in Afghanistan. Only, any of these can turn out to be a complete and utter Strop. They are painful reminders of the mistakes you made when trusting the wrong people.

I could tell you many sad stories of people who are trying to sell the stones they bought at crazy prices, under the assumption that they got a huge bargain.

People ask me from time to time about investing in diamonds. Can one who isn’t in the trade really make a profit? How should they decide what to purchase and how can they liquidate it at a later time? Let me stick to the basics. The elementary concepts about the diamond investment business, which can be madly fragmented and challenging.

If you want to be a successful player in fancy color diamonds, you need follow these points below:

- Ample liquidity, at least 100k better 300k that you are prepared to put aside for at least 5, 10, or 15 years.

- You buy a stone for cheap, with the intention of holding it for a long time.

- You have to buy the best, or at least almost the best, and below its market price!

This can be done ONLY through a trustworthy operator with an exceptional reputation who is prepared to offer you wholesale prices. - The company who takes your money and sells you a stone, must be the same company used to resell it again later on.

It needs to be an operator that is compelled to be true to their name and help you as much as possible. If it was a stone they believed in then, it will be a stone they can still believe in today. The same operator should be willing to keep the stone as part of their stock (physically or virtually) in case a good buyer appears.

The point of exit is the most important part of the whole investment.

If you don’t have all of these points mentioned above, don’t get into diamonds – or at least not through that operator. If people promise you an 8-10% yearly increase, or guarantee any future repurchase at a given price, be very careful.

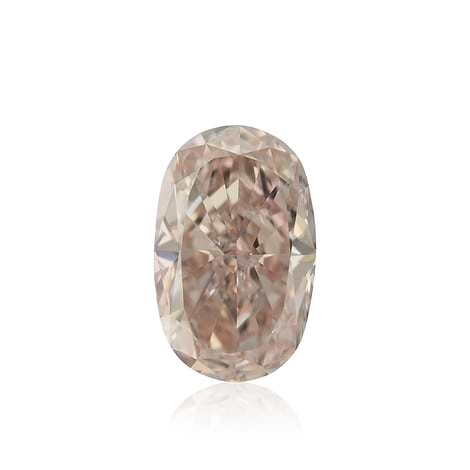

When bond trading at a 0.2% interest rate, no one can dream of an annual 8-10% appreciation on your investment. Fancy color diamonds have performed miraculously well over the last 10 years, and due to so many uncertainties in the market, they will continue to do even better. But it’s imperative that you remember that a pink diamond is not liquid as gold or bonds. You cannot just walk into a store and sell them when there is a need. You have to be financially independent from your investment in color diamonds. I personally prefer to own the actual stone and not part of any investment fund. It gives you better overview on your property, and you can always hold your asset on your finger.

I see investments in fancy color diamonds as part of spreading the liquidity in hidden spots for a long period of time. In this recent article from Russell Shor, a senior industry analyst at GIA in Carlsbad, he wrote that these spectacular sales seen at the auction house are mega tickets, but the smaller items also performed exceptionally well.

The world banking systems are in a real crisis. Financial institutions and private clients are suffering from the excessive effects of compliance. Holding or transferring money became an ordeal. In some secure investments and bonds, they are now offering negative returns. Because if you put down a million dollars for 10 years in the bank they will charge you $20,000 just to hold on to it. Bloomberg just recently published that diamonds are seen as the ‘Next-Best’ commodity after gold. Commodity investors are concerned that gold’s rally will sputter, and as a result they may want to consider other luxury items for long-term alternative investments. With odds of a U.S. rate hike creeping higher, and long positions in bullion soaring, as Citigroup Inc. analysts Barry Ehrlich said in a note, “it may make even more sense to look at the next-best commodity exposure such as diamonds, where there has been limited investor flow and presumably less downside in case the bear case unfolds.”

Diamonds Seen as ‘Next-Best’ Commodity After Gold Rally: Chart http://bloom.bg/29wWoQ2

Diamonds have been recognizes as a real alternative for secure investments and long term instruments for conserving wealth for generations to come.

Although I have said the same for a long time, as long as it is done the right way, I tried to again explain that I am not a guru. I am just walking with an open eye. When interest rates are near zero and you have to pay a fine to keep your money in the bank, fancy color diamonds are a great alternative to keep part of money secure.

Best regards,

Leibish Polnauer, President and Founder of LEIBISH Fancy Color Diamonds