If I told you that the Potomac River changed direction and water started to flow backwards, I assume you would be skeptical.

When the market reported that Amazon bought the Washington Post for USD250 million, everyone looked suspicious. Why would Jeff Bezos, founder and CEO of online trailblazer Amazon, spend USD 250 million of his own money to buy the Post?

Why didn’t Warren Buffet buy the Post? Warren served on the board of the Post for two decades and he was the largest outside shareholder. The price Bezos paid — two hundred and fifty million dollars in cash, minus a fifty million dollar contribution from the Post toward the future pension costs of its employees, didn’t meet Buffett’s valuation, and that’s putting it mildly. Warren buys money making potential, like he did in Bank of America.

Google looks to increase its market share or extend its technical capabilities so as to penetrate new markets and generate income from new sources. That is why it bought companies like YouTube and Waze.

Mr Bezos stated in an interview that the Post is “an important institution,” and he expressed optimism about its future: “I don’t want to imply that I have a worked-out plan,” he said. “This will be uncharted terrain, and it will require experimentation.”

In 2006, Google bought YouTube for USD1.65 billion. Many Wall Street analysts thought the acquisition price was way too high. Today Barclays value YouTube at USD15-20 billion, about 10 times the price Google paid in 2006.

It is forecast that YouTube will generate about USD3.6 billion in revenue this year. It has one billion unique visitors per month and is growing at 50% a year - it is a rocket ship!

Motorola Mobility in 2008 made a big bet on Android as the sole operating system for all its smartphone devices. That was one of the reasons Google bought Motorola. Google is great at software; Motorola Mobility is great at devices. The combination of the two makes sense and will enable faster innovation.

Motorola Mobility has a long history of innovation in communications technology and the development of intellectual property. It owns 17,000 patents but that is not the only value in the deal. Google sees the world of commerce as being ruled from our smartphone and tablet. Larry Page is not going to repeat the mistake of Facebook which ignored the huge potential of smartphones. Furthermore, in the past IBM missed the laptop revolution and was left in the dust for 20 years due to this oversight. Google wants to enter our mind from a smartphone and lead our search with these devices.

Google Inc. reported consolidated revenues of USD14.42 billion for the quarter ended December 31, 2012. Consolidated revenues would have been $15.24 billion had Motorola Home been included.

“We ended 2012 with a strong quarter,” said Larry Page, CEO of Google. “Revenues were up 36% year-on-year, and 8% quarter-on-quarter. And we hit $50 billion in revenues for the first time last year – not a bad achievement in just a decade and a half. In today’s multi-screen world we face tremendous opportunities as a technology company focused on user benefit. It’s an incredibly exciting time to be at Google.”

In 2012, Google had USD50.2 billion in annual revenues, USD10.7 billion in profit, and USD93 billion in assets.

Walmart had USD469 billion in revenue, USD16 billion in profit, and USD203 billion in assets. It employs 2.2 million people.

With USD48 billion cash on hand and 53,801 employees, Google is confidently powering ahead. The best part of Google’s business is that it does not sell anything; it does make money though on virtually every second sale over the Internet, charging the sellers for links clicked to its site or for completed sales.

Amazon has unlimited shelf space but it has to pay for the goods it sells and compete with brick and mortar stores with pricing and discounts.

When I was researching this article for my newsletter I saw our own fancy diamonds banner pop up 5 times in the financial information pages. Each time someone clicks on it Google makes a dime or nickel or even a dollar.

When an average guy drives to Manhattan for a morning trip to NY City, he will probably not visit Walmart or check his Facebook page during the drive, but he will encounter Google a number of times. Before he parks his car in downtown New York, Waze will tell him what is the best route to take, warning him of the obstacles ahead. Google just bought Waze for almost USD1 billion.

Google will show him the best service station on his road and who will wash his car also - charging the station for the click. Google will also recommend a dry cleaner and where to park his car- each time charging a dime to the cleaner for this service. Going for lunch to an Italian restaurant? Google will give its two cents – and charge its ten cents yet again. Then he goes shopping with his wife, holding his Motorola smartphone and looking where to go with the help of Google. Before the couple spend their first dollar, Google already made money on the search they conducted with their smartphone.

Just for the record:

- Incidentally, Google and the first version of our website leibish.com were established in 1998.

- In August 1998 when Andy Bechtolsheim gave the first seed money of USD100,000 to Sergey Brin, he could not deposit it in the bank as the company called Google Inc. was not yet established and they did not have a bank account. Luckily, today they have one with USD46 billion in cash.

- On September 1, 1998, Google set up a home office in the parking lot of Susan Wojcicki’s home at 232 Santa Margarita, Menlo Park.

- On September 4, Google turned to the State of California to establish a corporation. Shortly thereafter, Larry and Sergey open a bank account in the name of the new company and deposit the check of Andy Bechtolsheim.

- With that USD100,000 in seed money, the virtual revolution began.

Obviously I am not comparing LEIBISH with Google, but in the past 15 years we learned a lot from them and from the market also.

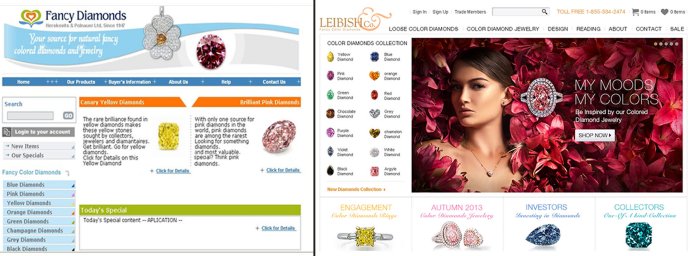

There are those that say www.leibish.com invented the Internet trade in color diamonds. I smile when I hear that overstatement. After all, what came first, the chicken or the egg? The one thing we definitely understood from the Google Motorola transaction though, is that our new website, Leibish.com, which will be launched in the very near future will be the internet address for all online searches via smartphone.

|

LEIBISH's official website changes from what is was when we originally began and what it will be with the new release |

Where is the future going in the virtual world? How will the Internet trade look in 10 years? I don’t know - but I invite you to share your thoughts with me.

.png)