The topic of diamond investments has been analyzed by all the major media outlets around the globe this year. Some remained positive, others focused on the challenges, and then there were some who discussed what worried them most about utilizing this asset. Still, no one can deny that the subject has garnered significant amount of attention.

The market has seen evolution, new advancements, and extraordinary occurrences over the past year. With the close of 2013, LEIBISH discusses what has happened over the past year and what we can expect to see in the coming year. Moreover, he focuses on what the investors need to be aware of.

What Investors are Looking for when Purchasing Fancy Color Diamonds

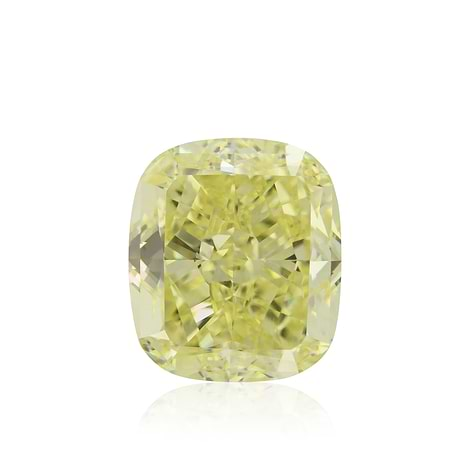

Normally, investors look for capital preservation, long term capital appreciation and wealth creation. The added value of investing in color diamonds is that there is an element of safety. At any given time, people seek safety, especially in today's global economy when the economy may seem negative. Fancy color diamonds are just like gold in the sense of safety, but better due to their portability and ease of transportation.

These luxurious gifts have always been recognized as an element of virtue, even among royalty, the rich, and the famous, and there are good reasons to believe they will remain so. This only strengthens the element of safety recognized in this asset class.

What Special Events have we Seen in 2013 that have Made a Significant Mark in the Fancy Color Diamond Industry?

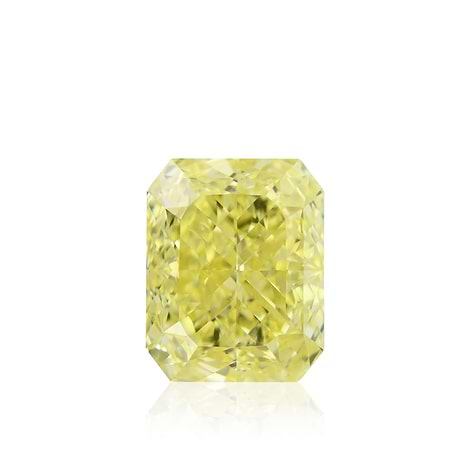

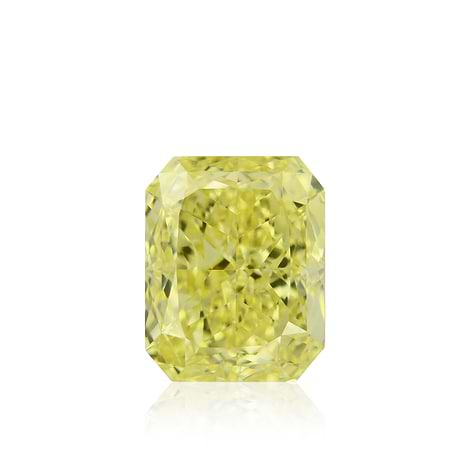

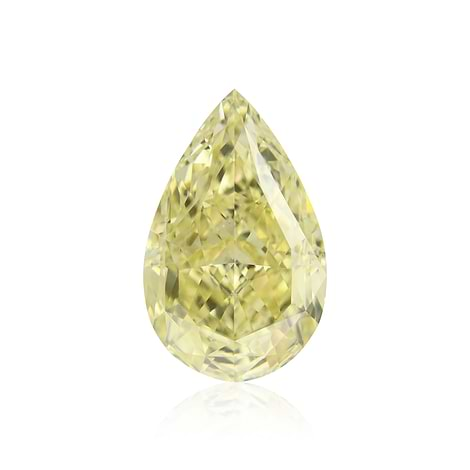

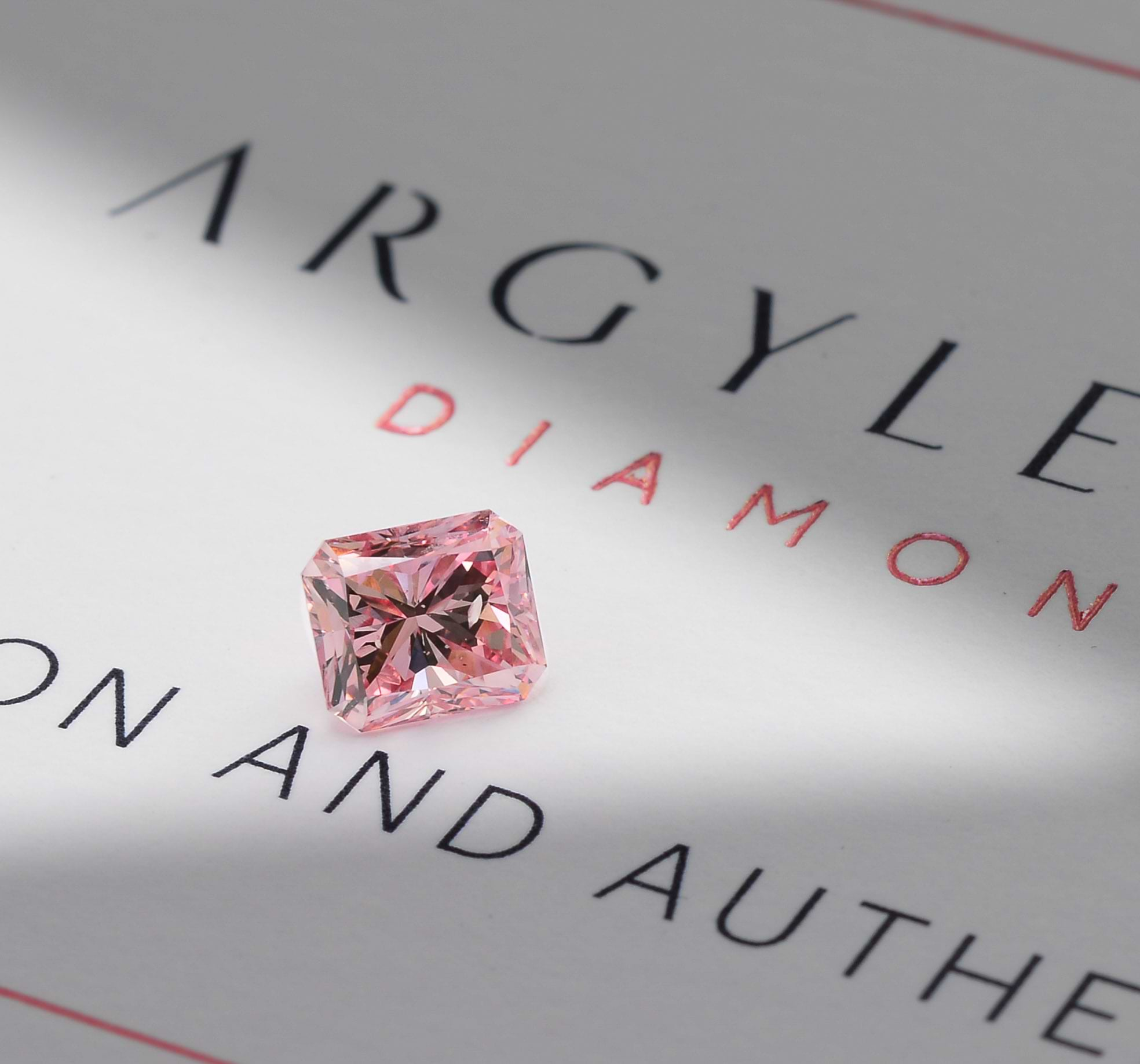

Many great things have happened in 2013. The overall biggest thing was that demand for fancy color diamonds has skyrocketed, due to the increase in public exposure (more people know these items exist and are available to the general public), color appeal, and value. Specifically two major events made headlines. First, the Orange, a Fancy Vivid Orange diamond, weighing in at 14.82 carats, was sold in October in Geneva and achieved the highest price per carat for any diamond. It was sold for a total price of $35,531,974, or $2,397,569 per carat! The second event was the sale of the Pink Star (renamed the Pink Dream) a 59.60 ct Fancy Vivid Pink , the very next day, also in Geneva, for an all time record price paid for a fancy color diamond in the amount of $83,194,250 million, or $1,395,876.60 per carat, to be exact.

What can we Expect to see in the Coming Year Based on what we Have Seen in the Market Over 2013

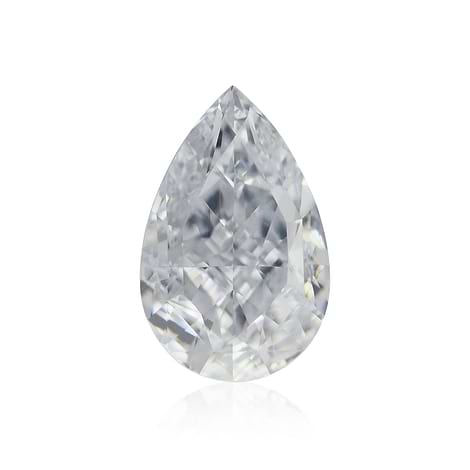

We believe that 2014 will see continuous increase demand for fancy color diamonds. World record price breaking only increases attention to the fancy color diamond market. Furthermore, the topic of diamond investments has been written and commented upon by so many major media outlets, which has significantly increased public awareness. Some focused on the positive aspects of this assert while others focused on the negative, but everyone is discussing it because it is a hot topic in the investment world. More than ever, various types of investors from the traditional channels of investment firms, wealth management, and family offices are starting to inquire about this market. Up until now, most investors have been individuals buying privately, or collectors, who buy special diamond colors such as orange, green, purple, violet, and gray among others. But, now we see a revolution and a keen interest from the institutional investment community. Although there are already those that have claimed that they have diamond funds, there is nothing close to the scale of what the investment community can handle. There are trillions of dollars on the sidelines ready to be deployed into alternative investments of which fancy color diamonds have a huge upside potential. We also see a further exponential increase in demand from countries like China and India, where the middle class is growing at a faster pace than ever before.

Some Important Milestones that we can Expect to See in order to Draw Institutional Investors?

The two most significant challenges that have prevented institutional investors and the investment community as one from entering into the fancy color diamonds field up until now are valuation and liquidity. The first, valuation, is key, because investment firms want to know how to evaluate an investment. Due to the fact that each diamond is as unique as a finger print, it is not possible to evaluate each and every diamond prior to investing in it. Price transparency on behalf of the diamond industry has been a challenge. Prices have been the private affairs of diamantaires for as long as trading in them existed. The second challenge is liquidity; although diamonds are traded constantly as well as purchased in every jewelry store daily, the wholesale trading is the challenging part. There is not yet enough trading facilities for diamonds that are traded as an investment commodity. There is not enough cooperation between the the diamond and the investment community. I am confident that once a common goal and ground are established, we will be able to see a new dimension added to this precious gift of nature. I believe that it will create new reverberating waves, and renew life on both sides of the ocean.