This cardinal has Winston written all over it!

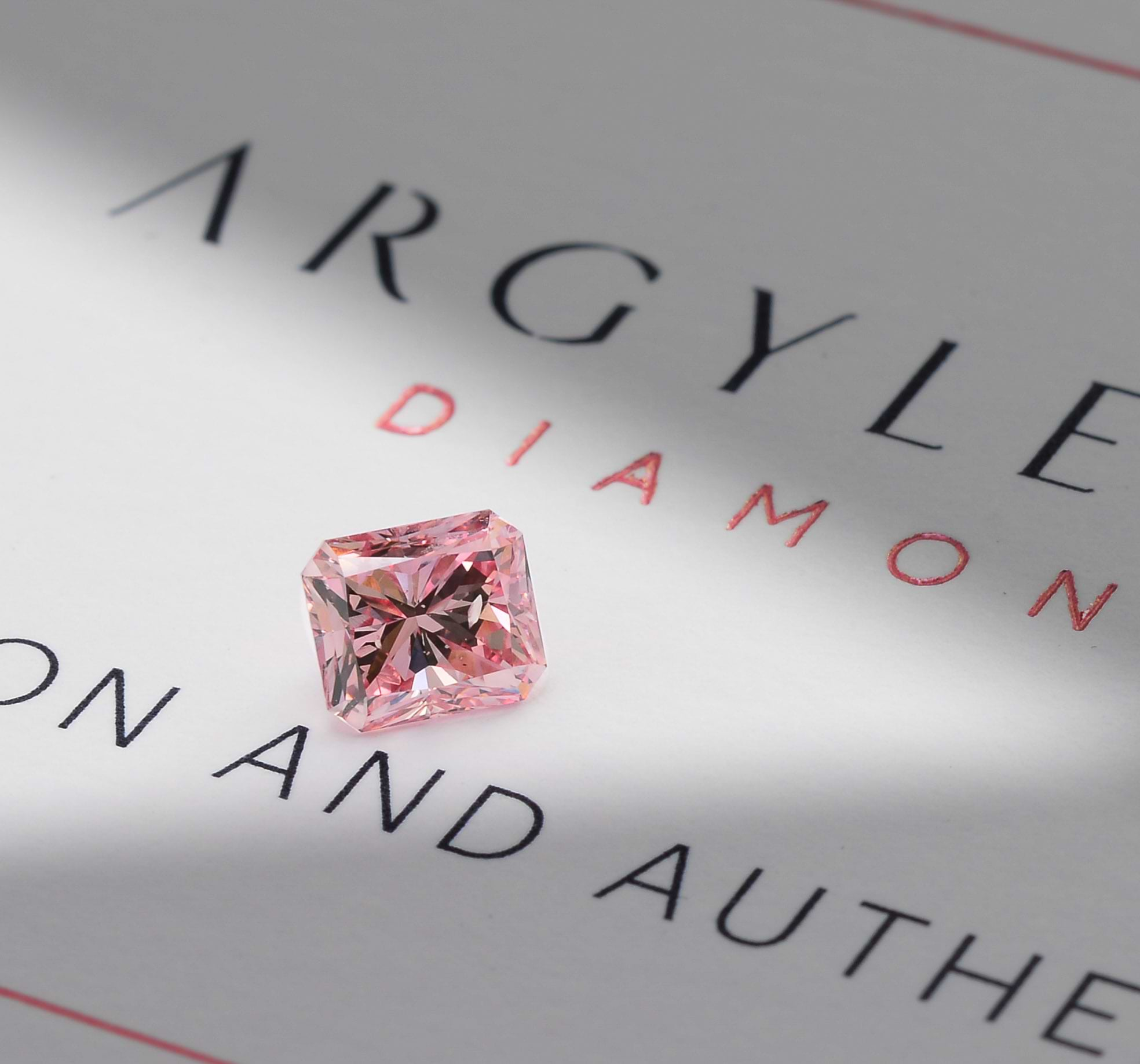

Today is the official kick-off of the month for the 2014 Argyle tender collection, its 30th anniversary.

When you look at the name Argyle gave lot #1, The Argyle Cardinal, and after looking at the cover of the tender, you immediately realize that Argyle meant for the famous Bird.

Almost 200 special invitations have been sent out to potential bidders, but in the last few years only dozens have actually showed up to the viewings of these Argyle diamonds. Not each attendant will bid, as some go just for the experience of viewing, and to have participated in this important annual event.

Rumors and Facts

Looking back at the comments made by an Argyle executive after the 2004 tender (the 20th anniversary) would make some of us, dealers, chuckle; the executives were ecstatic to announce that the average price paid for the 60 stones, 55.53 carats in total, was $100,000 per carat.

(source: http://www.auroragems.com/pdfs/bronstein-argyle.pdf)

Rumors have started that lot #1, the Argyle Cardinal, will likely sell for over $2 million. Last year, the winner of the tender was the 1.56 carat, Argyle Phoenix, a perfect brilliant diamond that supposedly sold for $2 million. Is the market being prepared for new records to be broken? If we analyze the numbers, and assume that the Phoenix sold for $2 million, this would translate to $1,282,051 per carat. The news from the mill currently speculates that the new 1.21 carat Argyle cardinal will sell for at least $2 million, which translates to $1,652,892 per carat. These numbers are incredible if you compare the year over year potential of a 28.93% increase, but still not all that surprising. Given that 10 years ago the price on average was $100,000 per carat, we can safely assume that the average yearly return for an argyle has been similar to the current expected return of just shy of 30%. The market is also indicating that as we get closer to the rumored closing of the mine by 2020, that the potential rate of return will further increase exponentially. Is it a bubble ready to burst? What other bubble has been growing and blowing up this way for 30 years? Or is true value given to rarity?

Is it the new “Winston Red”?

As recent as May 2013, a new record was established for a blue diamond; $1.8 million per carat. The world record per carat paid was also in Geneva back in May 2013 for the 14.82 carat Vivid Orange, at $2.4 million per carat. Although the three stones are different in every aspect, color, shape, size….I can’t help but think about size!

The Winston blue, a 13.22 carat diamond, sold for $1.8 million a carat, the vivid orange, a 14.82 carat diamond sold for $2.4 million per carat, but this cardinal is just a small pebble weighing 1.21 carats, and estimates are already over $1.65 million per carat. If the Cardinal sells for $1.8 million per carat, then it just surpassed a rare 13.22 carat stone, which in itself is extremely rare for fancy colors. So is this going to be the new “Winston red”?

After a long summer vacation, the market is quite ready for a fancy color diamond transfusion. The last four months of the year should bring a lot of excitement that should be enough for the full year.