MAKING A WISEINVESTMENT WITHCOLORED DIAMONDSFor centuries diamonds have proven as great instruments for conserving value. Financial experts have stated that a person should divide his possessionsin 3 parts: 1/3 Cash Funds 1/3 Transportable Assets 1/3 Real Estate What makes diamonds and especially fancy color diamonds an attractive instrument for long term investment? Diamonds have no shell life, they don't age, they never look old and they never lose their timeless sparkle. A one hundred year old stone looks as new as it was when it was just polished 5 minutes ago. So true is the well known phrase 'Diamonds are forever.' They are easy to conceal and transportable. A stone worth a milion dollars can fit into a thin parcel paper that sits in your shirt pocket. There are countries where people live in unstable economic conditions with oppressive regimes requiring them to hide their possessions. They may need to hastily, run from persecution. One cannot carry stock certificates, gold, or real estate - but can easily conceal diamonds in their cloths. It is said that for every 10,000 carats of white diamonds extracted, only 1 carat of fancy colors are found. Even still, finding color diamonds in a large carat size with good clarity is so rare, that each stone is valued extremely high. When assessing the inflation statistics over the past 30 years, the results are almost unbelievable. Such a consistent, steady, and constant increase is sure to prove the market value of these precious stones. More importantly - the real appeal of fancy color diamond is their rarity. A fancy color diamond is a unique item. Unlike a 3ct White F VS2 which is easily attainable, a 3ct 'Pink' or 'Vivid Yellow' is an exceptional stone, one of a kind, and very difficult to find on the market. As a long term investment, fine natural fancy colored diamonds not only maintain their value, but appreciate to a far greater degree than their white counterparts. In such volatile economic times, wouldn't it be wiser to invest in an asset with such meritorious attributes? That's why i've selected superb stones, I personally recommend as sound investments for generations to come. if you wish to receive my personal recommendation and assistance in building you a personalized Portfolio of fine Fancy Color diamonds for investment purposes, please contact us at info@leibish.com or call us at USA toll free: 1-855-LEIBISH (1-855-534-2474) International: 972-3-613-2122. Sincerely,

. For additional information and recommendation of fine Fancy color diamonds for investment, please don't hesitate to contact us at info@leibish.com or call us at: International: 972-3-613-2122.

AUCTION RESULTSCONTINUE TO SPARKLEPRETTY IN PINK Picture the scene: November 16, a packed Sotheby's Geneva auction room, |

and an air of anticipation.

All it took was four bidders, a world renowned diamond connosieur, an

exceptionally rare stone, and almost USD46.1 million (including buyer's

premium and commission) to set pulses racing and records breaking. The

price equated to $1.86 million per carat.

|

The 24.78 carat, VVS2 intense pink, emerald cut diamond, purchased by the inimitable Laurence Graff, is the latest precious stone, to claim the mantle of, "World Record Auction Price for a Precious Jewel". The diamond, promptly renamed "The Graff Pink," is further evidence of the insatiable demand for quality diamonds. The Geneva sale set a record total for Sotheby's at USD105 million, a figure well above presale expectations of USD66.8 - USD96.8 million. The Geneva sale set a record total for Sotheby's at USD105 million, a figure well above presale expectations of USD66.8 - USD96.8 million. |

|

|

AND NOW FOR AN ENCORE Not to be outdone, the Christie's Hong Kong auction held on November 29, resulted in the sale of a 14.23 carat, VVS2 fancy intense pink, rectangular-cut diamond for USD23.2 million (including buyer's premium and commission). The price equated to USD1.63 million per carat. "The Perfect Pink" is the most expensive jewel ever sold at auction in Asia. |

|

|

The Color Purple on 7 December, a rectangular-cut fancy vivid purple-pink diamond of 6.89 carats was the top lot selling for USD6,914,500 or USD1 million per carat.

|

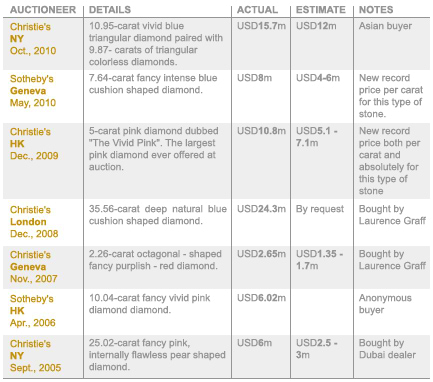

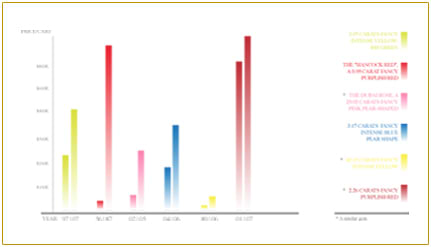

Some Auction Results from the Previous Five Years

The Evolution of Colored Diamond Prices

Following is a list of auction results for colored diamonds with comparative prices of similar stones:

| The Dubai Rose, a 25.02 carats fancy pink pear-shaped diamond:

USD6 million or USD240,000/carat (Oct., 2005, Christie’s - NY). A similar gem of 34.08 carats realized USD2.2 million or USD65,000 per carat in 2002 – a 271% price increase per carat over 3 years (90% annualized). |

|

|

A 2.26 carats fancy purplish-red diamond: sold for a world record price of USD2,667,567 or USD1,180,340/carat (Nov., 2007, Christie's - Geneva). A similar gem of 1.92 carats fetched USD1,652,500 or USD860,680/carat (Oct., 2001) – a 37% increase over 6 years (6.2% annualized). |

|

| A 42.13 carats fancy intense yellow diamond achieved USD2,032,000 or USD48,230/carat (Apr., 2006, Christie's - NY).

An intense yellow diamond of 43.08 carats sold for USD1,210,000 or USD28,100/carat (Oct., 1989) – a 58% increase over 17 years (3.4% annualized). |

|

|

A 3.07 carats fancy intense yellowish green diamond: realized USD1,206,400 or USD392,960/carat (May 2007, Christie’s - HK). The same stone previously sold for USD668,300 or USD217,700/carat (Nov., 1997) – a 55% increase over 10 years (5.5% annualized). |

|

|

A 3.17 carats fancy intense Blue Pear shape diamond: of fetched USD1 million or USD315,460/carat (Apr., 2006). The same stone previously sold for USD525,000 or USD165,615/carat (Jan., 2004) – a 52% increase over 2 years (26% annualized). |

|

|

The "Hancock Red", a 0.95 carat fancy purplish red round brilliant-cut diamond: realized USD880,000 or USD926,000/carat (Apr., 1987, Christie's – NY). It is believed the same stone was purchased in 1956 for USD13,500 or USD14,260/carat – a 6,500% increase over 31 years (209% annualized). |

Over the period 2000 – 2009, the quality-adjusted pink diamond tender price has increased by 150% - a 16.7% annualized increase. This compares to an approximate 20% fall in the DJIA and S&P 500 and a 40% rise in the Hang Seng Index over a similar period.

The appreciation in diamond prices equates to an approximate 16% straight-line rise compared to the inherent volatility in stock prices.

In Conclusion

From New York to Geneva, Hong Kong to London, the continued appreciation in prices for colored diamonds of strong provenance show no signs of abating.

This trend has been steady and evolving over decades. Through multiple economic crises, the market for colored diamonds has displayed resilience, stability, and returns ranging from "solid" to "spectacular". Compare this to other investments and colored diamonds exhibit very attractive investment characteristics.

Another point worth noting is that many of the purchasers of colored diamonds are trade buyers. As in any industry, the "insiders" are usually the most knowledgeable and best informed. The diamond industry is no different. The corollary to this is that those who know the diamond market best are consistently paying record prices for quality colored diamonds. What does that tell you about the health of the colored diamond market?

Money can be printed, bonds and stock certificates can be issued;

however, the rare gifts of mother nature will never be duplicated or

surpassed.

contact us at info@leibish.com

To Read more about invsetments in colored diamonds:

500 Points Up, 500 Points Down - Diamonds Are Forever

Lunch with Warren Buffett - President corner August 2011

To read more about Investment in Diamonds

To read more about Investment in Pink Diamonds.

To read more about Investment in Blue Diamonds.