Divesting the Monolith

Those planning to attend JCK Vegas (May 31-June 3) or following its headline news have already read about the proposed sale of De Beers. Anglo American, currently the 85% stakeholder of De Beers, announced it will “divest or demerge” it from its portfolio.

Wait—Not so Fast!

But De Beers CEO Al Cook is not sitting idle waiting for the company to be sold or worse, become chopped up. He and Gina Drosos, CEO of Signet Jewelers unexpectedly came up with a stunning joint venture plan which could have a tremendous positive impact on the diamond industry as well as on De Beers and Signet too.

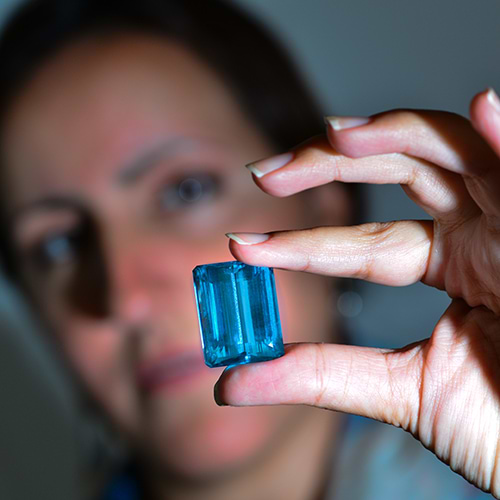

(Credit Photo: COURTESY OF SIGNET JEWELERS AND DE BEERS GROUP)

Marriage Made in Diamond Heaven

“The world’s biggest diamond producer, the world’s biggest diamond retailer, you can only bring them together once,” Cook says. “This is bigger and better and different than anything we’ve ever done,” he emphasized.

It was an exceptional move which placed both companies at the pinnacle of luxury news for the jewelry industry. De Beers and Signet Jewelers with its 2,700 stores worldwide, have joined forces to promote the natural diamond brand.

The new partnership between De Beers and Signet will roll out in stages. It has just begun to promote the natural diamond brand, and will see the retailer re-educating its 20,000 sales associates on the benefits of natural diamonds.

Drosos further addressed the LGD, or lab grown diamond issue. It still represents only a minor (low-teens) percentage of Signet’s overall revenue, she confirmed. Signet’s CEO projected that the US engagement rings market will grow 25% over the next 3 years. This growth is led by multicultural diamond customers, who Drosos explained are “disproportionately interested” in natural diamonds.

The central message of the joint De Beers - Signet statement is this.

The cooperation delivers a tremendous strategic edge to both parties. Suddenly De Beers appears in a different light. They are not a failing diamond producer with ongoing losses of market share. They’re innovators keeping pace with the times by creating a brilliant a joint venture with a proven retailer with the biggest market penetration in the USA.

And Just Like That

Suddenly a heavily discounted sale of De Beers is not on the table anymore. “There are a potential number of pathways,” offered Anglo-American CEO Duncan Wanblad. “All of them are on the table at the moment.” Describing the sale as a journey, he said any sale needs coalescence with “one of our most important stakeholders, which is the government of Botswana,” Wanblad reassured.

Botswana, with its 15% stake in De Beers has dreams of going downstream, not just selling rough. They want to make jewelry and market it to the end users.

Elephants in Botswana

Elephants in Botswana

Consider This

If there is a De Beers -- Signet merger, or if Signet would buy De Beers or even part of it, this presents the natural diamond in an entirely new light. The potential magnitude of such a venture is huge, including countless fast developing aspects.

A Look at the Numbers

Signet’s total sales in 2023 were $7.8B, twice that of De Beers sales. Signet capitalization of $4.5B would likely include part of the financial structure coming from outside. De Beers capitalization figures in at $7.8B, according to Anglo American.

“Whatever happens as far as De Beers is concerned,” said Wanblad, “in a new ownership structure or an independent company spun out of Anglo American, the relationship with the government of Botswana is an absolute key component to the success of that business. I don’t see any reason that the current agreement would change.”

This joint venture with Signets 2,700 stores could pivot De Beers prospects and valuation from uncertain to good.

How it Was

According to De Beers, “Global Sightholder Sales sells around 90% of De Beers Group rough diamonds, by value, via term contracts to customers known as Sightholders.”

From the beginning, De Beers treated its Sightholders like servants--- keeping them constantly on edge by worrying they might lose their place in line for the allocation of rough presented 10 times a year at events called Sights.

Still, things seemed to go along smoothly ---- until they didn’t.

The music stopped and Sightholders quit dancing to De Beers tune. It wasn’t long before their black servant Botswana woke up and started to flex its muscle too. Pushing DeBeers into a corner, they compelled the company to move the distribution of the Sight to Botswana’s capital of Gaborone in 2014.

How it Played Out

That was the beginning of the end for DeBeers so-called monopoly. They ignored the enormous Iceberg in front of them. They sailed full speed-ahead like the Titanic did a century before, sinking soon after hitting an Iceberg. Both De Beers and the Titanic claimed to be unsinkable.

Most years, the number of Sightholders was around 94 diamantaires. This year, reported JCK Online, “There are 20% fewer Sightholders than previously, which is not surprising given DTC’s (Diamond Trading Company) reducing share of the rough diamond market.”

Today all Sightholders are linked directly to the Botswana miners, so they don’t actually need De Beers to sell their rough anymore. But with a De Beers - Signet joint venture, The Botswana government will surely want to be part of it and will not play around with the distribution agreement they signed with De Beers. The Sightholders will also be happy to see the prices of polished diamonds finally stabilize and go up. Probably few of the Sightholders would love to be part of the new venture, direct line to the 2700 stores.

New partnership between De Beers and Botswana Government

New partnership between De Beers and Botswana Government

Setting the Record Straight on LGD

I don't even want to speak about lightbox---De Beers biggest fiasco yet. That colossal misstep struck a nearly lethal blow to natural diamond prices, which tumbled this year by 15-20%.

In the joint statement issued by Drosos and Cook, they confirm LGD are not on the table anymore.

“There is misinformation that makes consumers think lab-created diamonds are a better environmental choice,” Drosos said. “I disagree with that since 80% or more of lab-created diamonds are made with fossil fuel. And it takes a lot of heat and pressure to make one in football field-sized facilities over three weeks of production compared to what the Earth has done naturally over a billion years.”

The Right Side of Responsibly Produced Stones

“Natural diamonds are the perfect symbols to celebrate life’s most meaningful moments,” De Beers Group CEO Cook said in a statement. “We now have the opportunity to connect a diverse new generation to the extraordinary attributes of natural diamonds. I am so proud of the good that diamonds do for the people and places they come from.” De Beers mining operations employ thousands in Botswana, Namibia, South Africa and Canada.

Diamond Mining Operations in Botswana (Photography of Steinmetz Co., Gaborone, Botswana]

“Natural diamonds are unique and rare. They have specialness, legacy value and hold their financial value. As lab-grown diamonds become more plentiful, natural diamonds will become more and more rare,” Drosos said.

We will once again witness the eternal message of De Beers from 1947, Diamonds are Forever.

LEIBISH Round White Diamond Three-stone Engagement Ring

LEIBISH Round White Diamond Three-stone Engagement Ring