Bitcoin is a virtual currency that can be used by peer to peer which is not controlled by any government or financial entity. They are created vis-à-vis users who offer their computing abilities and power. Bitcoin is becoming quite popular by merchants as a payment currency, due to the lower than normal processing fees of 2-3% used by other credit card companies. Up to now, all individuals acquiring bitcoins, have done so for speculation purposes, thinking that the demand will be strong, although supply is tightly limited. During the last 12 months Bitcoin has been seen in the investment world as both a star and a dog, with similar behavioral deviation in value as the tech bubble of 1999-2000. In just under a year, the value of Bitcoin went from less than $100 USD to almost $1200, just to come crashing to $400, although now it currently stands at around $600.

There are two sides to every coin as to why people should trust it and why people shouldn’t. At the same time, we will have a look at our fancy color diamonds valuation model, to help our readers who repeatedly ask themselves about which would be better speculate in.

A 5D Analysis

To be fair, we decided to compare both in a unique but significantly meaningful way. For beginner investors, these concepts may seem very abstract. However, for seasoned experts, who invest in the millions on an annual basis, these factors are extremely significant determinants. We looked at 5 distinctive attributes that can be analyzed for both- Portability, Privacy & Security, Demand, Supply and Universality, which are the main factors when you analyze high grade investment options.

Portability

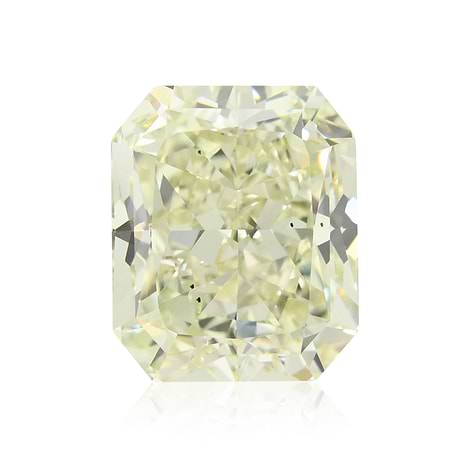

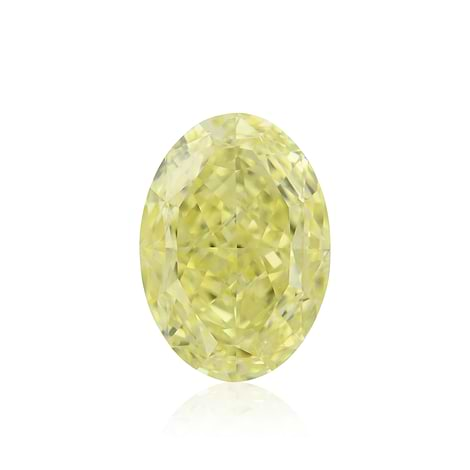

A fancy color diamond can be transported anywhere you want, since it weighs very little and can be carried very inconspicuously. If we use a rare average weight of 10 carat, which is 2 grams for those aren't familiar with the weight conversion, whose worth can be as much as $10 million - it is in fact quite transportable. Conversely, while Bitcoin is a virtual currency, and has no weight, and can be transported virtually anywhere you go at any time, its sole existence is cyberspace – and you will never be able to grasp it. Also, the equivalent of 2 grams of Bitcoin is definitely not $10 million! Therefore, while they may both seem to be equally transportable, their value is not calculated to nearly the same extent, and Bitcoin's lack of physicality is a detriment as something that exists entirely virtually can disappear very easily.

Privacy & Security

Currently there are no true tracking possibilities of a diamond. However, once you convert your wealth into a diamond, and transport it with you to your destination, it can be converted back into cash, with relative ease- and all this is done anonymously. The same goes for Bitcoin. Since it is virtual, and its owner is also anonymous, you can transfer the virtual currency to whomever you want to wherever you want with ease. Similarly, you remain anonymous, which is quite a desirable trait to people who need to transport high volumes of wealth, even if you do not plan to use it in any way, but are just planning on letting it accumulate in volume and collect value. However, the difference between the anonymity benefit between the two is the surety of its begin replaced in case of any problems.

Bitcoin's privacy may be totally anonymous, but a successful hacker may be able to empty a Bitcoin account, with little effort in tracing the true owner. Since Bitcoin is not insured, there is nobody with which to file a claim. There are only 4 Bitcoin exchanges, and they are completely not regulated by any formal value. Its current stage of development still stands as not being backed by any government (since it is not in any government's best interests), so it is only of interest to speculators with nothing to lose – it is only traded between those who are willing to accept it. Governments do not want Bitcoin because it is not controlled by anyone, anywhere. In fact, the value of Bitcoin tanked twice, once when the US government refused to accept Bitcoin, and once when the Chinese government did the same, which caused the speculators a significant amount of emotional fear and a subsequent loss of value. Any new creation is only as valuable as it is accepted in the world economy and backed up by a significant body – if not, it will have no universal (or any) value to most of the world, and will not be desirable. Its current dollar value is purely because the world's universal currency is dollars. If the world traded in Euros or Renminbi (China's currency), then that would be the exchange value of Bitcoin.

Conversely, diamonds have not only historical price information, but also universal acceptance. The future is almost always a reflection of the past, with some exceptions (it may be that a governmental body will throw themselves behind something new and give it a brand new worth, but this is not likely or common). They not only have a universal valuation system, and whose net worth is exactly the same no matter where you travel, they also have historical precedence and have always been viewed as items of significant value for millennia. Whether it is governments, businesses, investors or individuals, all bodies view diamonds with the same approach. Thus, diamonds are a significantly safer investment than Bitcoin (if surety is a concern for you!)

Demand

The most unfortunate question that Bitcoin investors face is whether it is a short term trend, or if there is a long term possibility of it becoming the first virtual currency. It is still too early to know. Currently there are more speculators in the game than anything. However, the fact that there is no institutions backing it is not a good indicators for its future success.

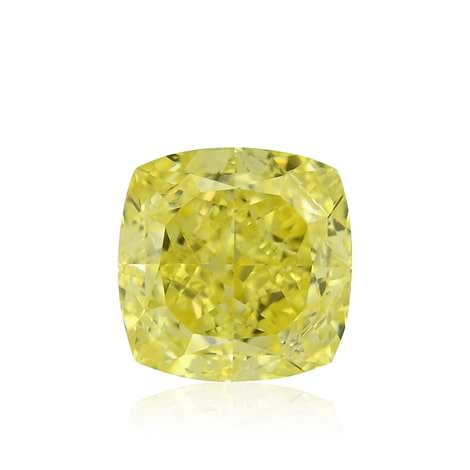

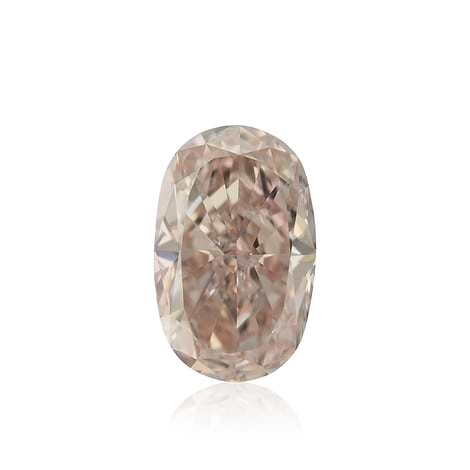

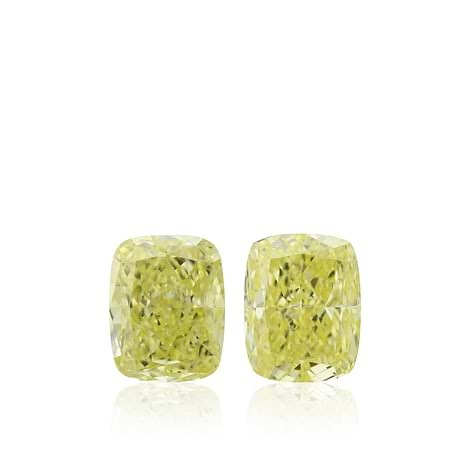

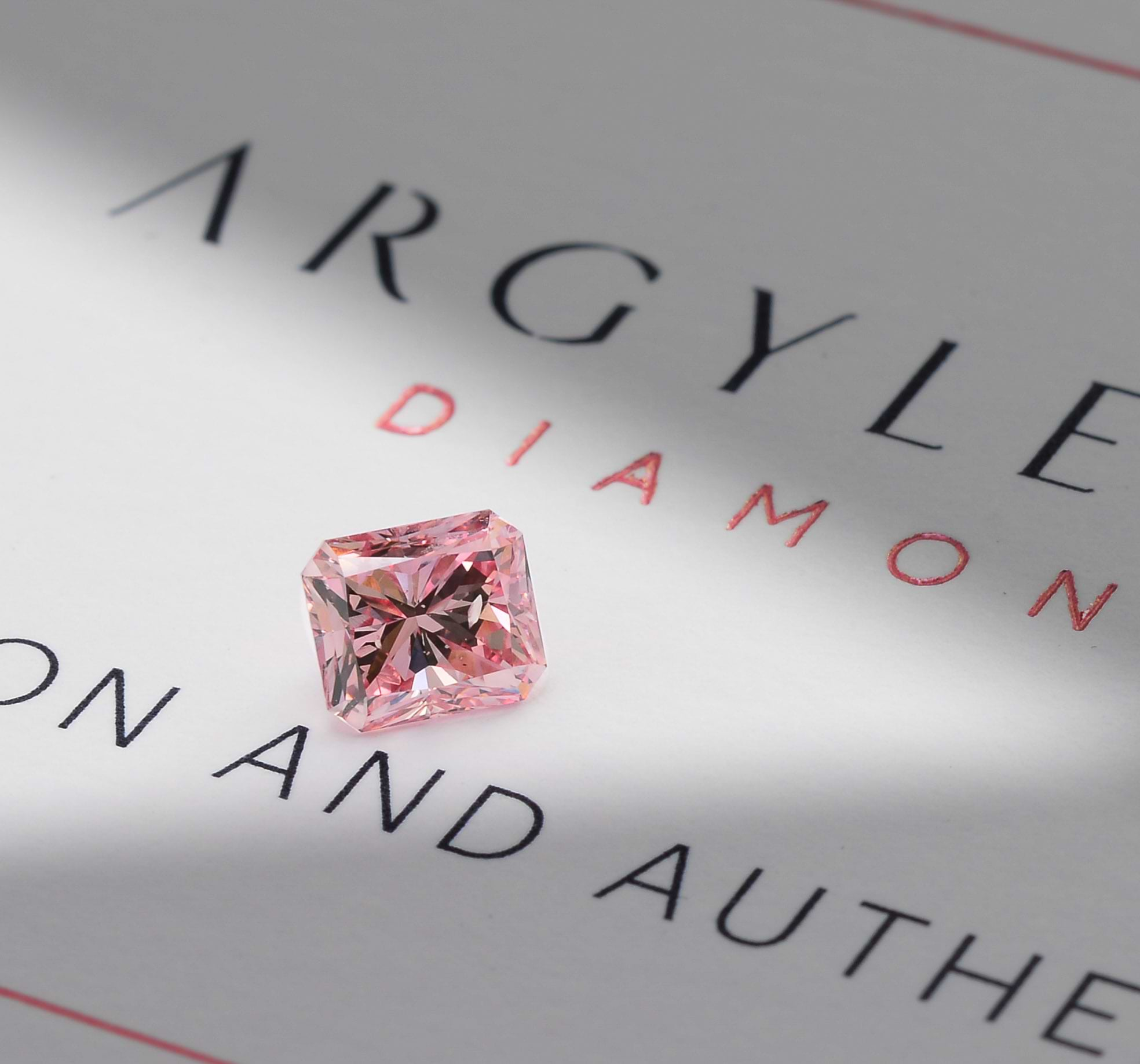

Fancy Color Diamonds, on the other hand, have been around for millennia, and have always been used for trading and wealth creation. Up until now, these have been used for high end valuable jewelry, and now recently have been collected as investment vehicles by a few. In a short term perspective, this is a trend to invest in as these diamonds get a lot of exposure by the media. However, in the long term they are notable because they will continue to receive the same exposure for a long time. Like any other commodity of a vehicle to gain and create wealth, there is always going to be a group of speculators that will join the game, but in the case of color diamonds, that will not be significant enough to affect the value that it gives.

Supply

In the case of Bitcoin, the most that will ever be created and that can ever exist is just under 21 million bitcoins. This amount will be reached by 2140, and this digital currency is created by mining. The amount of Bitcoins that can be created is halved every 4 years until you reach 0. The first 4 years the maximum number that were created was 210,000 Bitcoins (see Wikipedia for further information). Depending on demand, this supply may not be sufficient, therefore Bitcoin has the ability to become rare, and thus the value has a strong but questionable possibility of increase (depending on how much value individuals give it).

In the case of fancy color diamonds, supply is limited to approximately 0.01% of the world supply of diamonds. On a yearly basis, there is roughly 153 million carats of diamonds that are mined. This means that Fancy Color Diamonds make up only 1.53 million carats. Based on the current volume of demand, this supply is also not nearly enough, and so the valuation of fancy color diamonds will likely increase significantly. Currently the supply-demand growth is an incredible 2:1, according to Bain & Co.

Universality

We can look at acceptability in many different ways. One of those is governmental; no government has or will eliminate fancy color diamonds as a means of wealth creation, or as a means of exchanging it for other goods or services, although it is not practically used in that manner. On the other hand, Bitcoin is monumentally in that it has been “excommunicated” by several governments.

Bitcoin has been accepted by many online retailers as a mean of payment for goods, but I believe it is a short term marketing blitz and a stunt to attract consumers their website with the hopes that they purchase items and continue to purchase in the future, even if Bitcoin becomes obsolete. Just look at how much exposure these online retailers got when they announced that they accept bitcoin as a mean of payment! If I was a shareholder of these companies, I would sell the stock. It is irresponsible on their part to put my investment at risk by accepting a form of payment that is not, the least to say, regulated or have a more stable valuation element. The funds are not technically considered proper revenue whatsoever considering that they are a currency that is completely unreliable and with no standard of valuation!

Conclusion

In order to make a well informed decision in anything, a wise investor will take facts into account. Generally, this includes historical information, knowledge of governments' trust and preferences, since they will likely influence the outcome, and an element of stability. While each investor will likely make his decisions based on his own practiced set of factors, the fact of the matter is that there are certain universal and inarguable elements that are always a deterrent to the wise professional. In the case of Bitcoin, many developing elements remain to be seen. However, this risky and popular question is one that has quite a ways to go before it can reasonable be concluded that it is a wise outlet for your investment assets.

Let me know - what do you think?